The overnight rate went up again?!

What does it mean for you and your money?

As expected, the Federal Reserve hiked the overnight rate another 75 basis points at its July 2022 meeting.

After all these years of loose fiscal policy, why now?

It is a one word answer… Inflation!

Inflation is the highest it has been in 40 years and we are all “feeling the pinch”.

Prior to the last FOMC decision inflation stood at 8.5% year over year which is obviously way above the target of 2%.

Our Federal Reserve has the tools designed inflation under control.

And their financial carpentry skills are being put to use.

After this last rate increase, it seemed that inflation may have gotten under control as inflation was flat in July 2022.

But then…

August numbers were released, excluding energy, the CPI increased .6% sequentially from July 2022.

The CPI, consumer price index, was largely expected to decrease in August but following this news…

The market reacted, falling nearly 1300 points on September 13, 2022, following the news.

But why?! Why would this inflation data cause a selloff in stocks?

Because it greatly increases the chances that the Federal Reserve will once again raise the Federal Reserve will increase the FFR, or overnight rate, once again at its next meeting.

It Will Happen Again

The Federal Reserve will likely increase rates and according to Federal Reserve Chair Powell, we should expect “some pain”. But what impact does raising the overnight rate have that will cause pain? And what should we, as investors, do about it? Read on to learn what is supposed to happen when there is announcement of a Fed decision to increase the overnight rate.

The Cost of Interbank Borrowing Increases When the Fed Raises the Overnight Rate

Fed Funds Rate

When the Federal Reserve announces a rate increase of 75 basis points, they are specifically increasing the Fed Funds Rate that banks charge each other to borrow money in the overnight market.

If member banks dip below their reserve requirement and need to borrow cash quickly from other banks to satisfy these requirements, they must pay more in interest to cover. As of August 2022, this reserve requirement is 0%. However, the Fed has the ability to increase this reserve requirement. Should this increase, it would make them less likely to lend and should therefore make them require more interest from borrowers as a result.

Interest Rate on Reserve Balances (IORB)

Simultaneous to this Fed Funds Rate increase, the Federal Reserve also increases the interest rate of reserve balances (IORB).

This is relatively new.

In July 2021, the Fed combined the IOER and the IRR into one single rate creating the IORB rate. Up to and including July 28, 2021, interest was paid at an IORR (interest on required reserves) rate and at an IOER (interest on excess reserves) rate. The IORR rate was paid on balances maintained to satisfy reserve balance requirements, and the IOER rate was paid on excess balances.

Since the Federal Reserve has lifted the reserve requirement mandate on banks, this rate has, quite arguably, a much more powerful immediate impact on prevailing interest rates.

What is the New IORB

This is the rate of interest that the Federal Reserve pays on balances maintained by or on behalf of eligible institutions in master accounts at Federal Reserve Banks. The interest rate is set by the Board of Governors. Rather than some banks utilizing the overnight funds rate, this rate hike immediately impacts the reserves of all banks.

Prior to this year’s first round of hikes, this rate stood at .15% as recently as March 16, 2022. After this round of increases, this risk-free rate stands at 2.4%. This rate should filter throughout all interest rates, increase the cost of borrowing, and throw a little water on the inflationary fire ravaging the US.

Relationship Between the Overnight Rate and Treasury Yield

Yields on US Treasuries should increase as the Fed Funds rate is increased, especially short-term interest rates. And there is an inverse relationship between yield and bond prices. For bonds to yield more, the price of the underlying bond must decrease.

(For a method of calculating the direct impact of yields to bond prices click here)

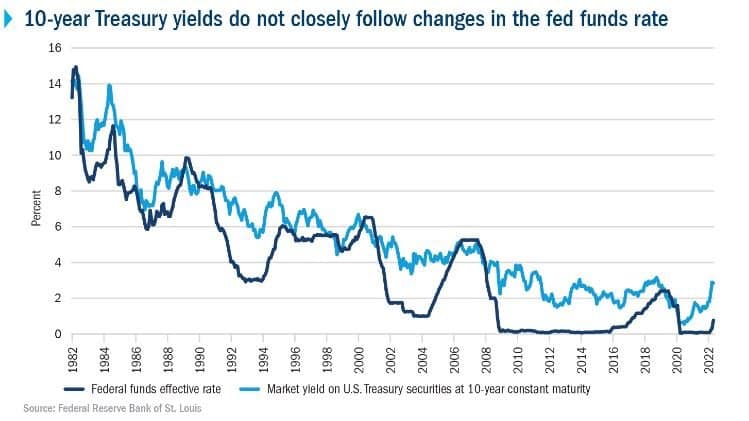

10yr Treasury Vs Fed Funds Rate Chart

Despite this most recent rate hike that saw the IORB rate jump from 1.65% to 2.40% on July 28, 2022, the yield on the 10 yr. US Treasury had actually fallen from a high of 3.48% on Jun 14, 2022, to 2.61% on Aug 1, 2022. As can be seen in the chart on the ten-year treasury yield, the overnight rate changes are muted when compared to the actual change in the long-term treasury yields.

How Does Raising the Overnight Rate Affect Inflation

We need to combat inflation –Agreed!

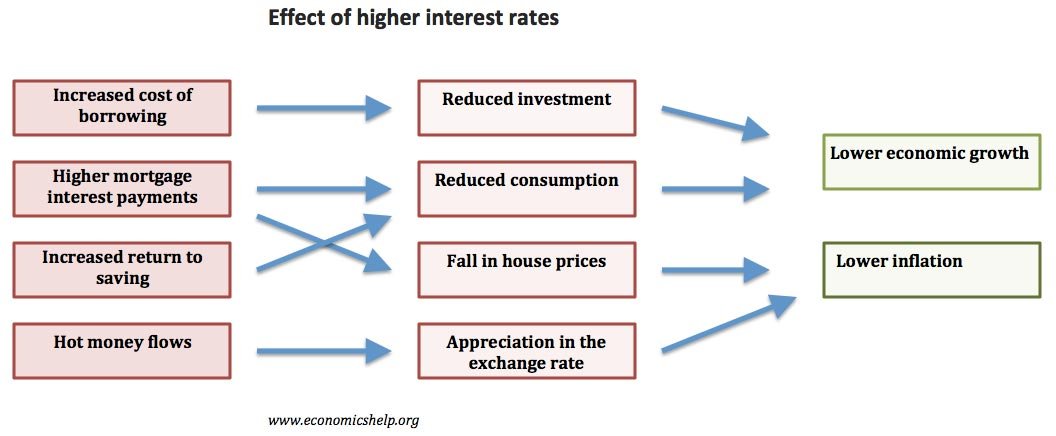

Inflation is at the heart of the Federal Reserve’s interest rate hikes. From an economic standpoint, increasing Interest rates is a demand side approach to combating inflation. Increasing interest rates causes a shift in the demand curve for money, the results of which are as follows:

- Therefore, the equilibrium quantity of money demanded will decrease.

- The cost of borrowing money increases.

- Resulting in a lower money supply.

- And therefore, a decrease in the equilibrium nominal price for goods and services.

But what happens to an economy when interest rates go up stemming from this increase in the overnight rate?

Increased Cost of Borrowing

The most obvious and immediate impact of an interest rate increase is the increased cost of borrowing. Increased costs of borrowing will reduce investment which results in lower economic growth.

Higher Mortgage Interest Payments

Higher mortgage interest payments will reduce consumption and ultimately result in a fall in the price of homes (all other things being equal). This results in both lower economic growth and lower inflation.

Appreciation in the Exchange Rate

Also, inflationary pressures are lessened because interest rate hikes create an appreciation in the exchange rate (assuming the entire world doesn’t simultaneously increase rates) resulting in lower inflation. The stronger dollar will incentivize foreign inflows to US banks and will work to decrease exports and increase imports.

Lower Capital Expenditures

Higher costs of borrowing also create a disincentive for capital expenditures from large firms, which is also disinflationary. Ultimately, the risk-free rate going up increases the required rate of return from any capital expenditure. And the risk premium required for this capital expenditure can also go up due to the expectation of future rate increases.

What Should You Do in the Face of Overnight Rate Increases

What is the most important thing you can do for your long-term goals in the face of these overnight rate increases?

Stay Invested for Retirement

The right time to invest in companies with long term value is always right now. I know when the headlines read, “interest rate hike”, and the market seems to be in freefall, there is a tendency to be fearful. But this might be the very best time to add to your positions. It might also be time to reexamine your goals and get a fresh set of eyes on your portfolio.

As the Federal Reserve continues to fight inflation, the most important thing an investor can do is meet with an investment advisor. Someone that has been in the business of helping investors realize their goals at retirement and beyond.

Research

We find the value.

Certain industries are certainly more negatively affected by increased costs of borrowing than others. The old model of capital-intensive industry isn’t the environment we live in today.

But where to invest?

There is tremendous value in the equity markets right now (despite the headwinds in the pharmaceutical industry).

At Dupree Financial Group, LLC; it is our duty to perform the due diligence in everything in which we invest.

Research is at the heart of everything we do for our clients, and we have been doing it for generations. This fundamental research gives us the confidence to weather any storm and find long term value for our firm and to help you achieve your goals. Before you make any decisions that might get you off track from your goals, you owe it to yourself to get an absolutely free, no-obligation meeting with the professionals at Dupree Financial Group, LLC.

For our latest free report click here: Value Investing Redefined Just enter your email and we will rush this valuable value report to your inbox.