Why would anyone invest in the top 10 pharmaceutical companies?

The most hated industry in America is the pharmaceutical industry.

Yet, for some reason, investors still buy shares… but why?

Well…

It seems like everyone is using their products…

Today, almost half of Americans have used at least one prescription drug in the past 30 days. Nearly 25% of Americans use at least 3 prescription drugs monthly.

Investors crave yield…

From the viewpoint of an income investor, the yield is very attractive. And in the current inflationary environment, where we are all feeling the pinch, this desire for yield seems to grow in importance. The current simple average forward dividend yield of the top 10 pharmaceutical companies is 3.84%. This surface metric compares very favorably to the S&P 500 yield of 1.64% at the close 9/6/2022.

And past performance is solid…

Looking in the rearview mirror at performance, the broader index of pharmaceutical companies has performed well. The iShares U.S Pharmaceuticals ETF (IHE) tracks the performance of the industry as a whole and has performed well over the past decade. On September 1, 2012, this ETF traded for $89.63 and at the close on September 1, 2022, it settled for $176.98 for a return in excess of 97% during this 10-year period.

So, what’s not to like…

With all of these positives, why don’t I invest in the top 10 pharmaceutical companies?

Read on to learn 3 major things that make me less than excited to invest my money in these marketing giants.

I Do Not Like the Marketing Model of the Top 10 Pharmaceutical Giants

I am thankful that modern medicine exists.

There are some wonderful prescription medications that do work and have increased the longevity of mankind.

From 1990-2015 the average life expectancy increased by 3.3 years. It is estimated that 35% of this increase is directly attributed to the advancements in biopharmaceuticals or roughly 1.15 years. This is mostly attributed to better outcomes for patients with HIV, breast cancer, and heart disease. There have certainly been advancements in the treatment of these conditions. For these advancements, I have the utmost respect.

However,

Something Is Rotten in the State of Denmark

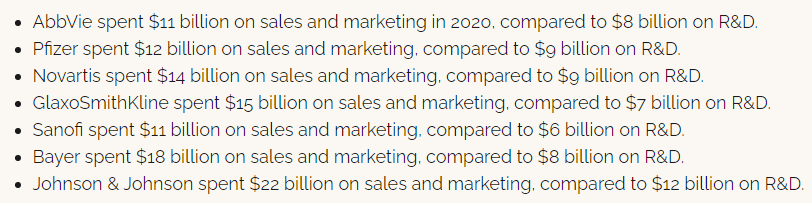

Something is wrong with this crucial lifesaving industry when you consider that more money is spent on advertising than research and development.

For patients battling serious diseases, is direct to consumer, DTC, advertising needed?

Look at the following statistics:

For many of these types of promotional activities, the industry is actually creating a disease through marketing then promoting their solution to this either extremely rare or non-existent condition.

“Disease mongering” isn’t new…

Promoting a condition as a “disease” isn’t new and thanks to Lynn Payer it has a name.

In her book, “Disease-Mongers: How Doctors, Drug Companies, and Insurers Are Making You Feel Sick.” she explores the history of the practice of “disease mongering”.

One well known example resulted in a product we all know too well. The creation of the “disease” halitosis was created to sell a surgical antiseptic, Listerine. Through clever marketing many of us rinse our mouths out to cure this non-disease.

This past weekend I had this “disease”. I ate something called bagna cauda and claimed the couch as my bed (even the cat wouldn’t let me sleep on the back porch). Although delicious, the garlic from this delicacy coursed through every pore of my being. Even today, I can still smell some of the effects of this treat, but luckily this disease had a remedy.

Thank you, Joseph Lawrence (the creator of Listerine), for providing this life saving medication and promoting it as such.

But now, through clever marketing, we can cure all sorts of “diseases”

Here are just a few conditions that the pharmaceutical industry has cleverly advertised as diseases:

Social anxiety disorder, intermittent explosive disorder, attention deficit disorder, irritable bowel syndrome, restless leg syndrome, premature ejaculation, female sexual disorder, low bone mineral density, and social anxiety disorder.

Many other “diseases” have all been cited as examples of conditions whereby pharmaceutical companies have been accused of disease mongering.

This is not to say that these diseases or maladies don’t exist. And that in many cases treatment can help. It is just that through clever promotion, the boundaries of the disease are widened to make it seem legitimate for medical intervention for more and more people.

The Incentive Structure of Big Pharma Should Not Be Rewarded

From a philosophical standpoint, I do not support the incentive structure that is employed by the top 10 pharmaceutical companies.

In a recent interview with a pharmaceutical sales representative the following statement was made:

Here the representative is expressing quite a bit about the job. He is stating that people (doctors) don’t believe in the product and his job is to make them believe in it.

He gets compensated on a bonus structure that is paid on a commission basis, like almost all sales jobs, to make them believe in the drug. This is with the caveat that the reason the product is superior is because it exists. The incentive is to push the drug by making the doctor believe the drug needs to be prescribed.

Education is Good

This isn’t all bad. Educating the prescribing public on the efficacy of a prescription pharmaceutical drug is certainly reasonable, but wait there’s more…

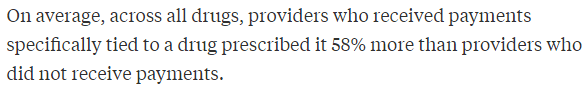

It turns out that in addition to paying drug reps to “educate” prescribers, the best way to get doctors to prescribe more of a drug is to pay them directly. A study published in 2019 found that:

Should we invest and support an incentive model that pays the prescribers to prescribe?

The Current Regulatory Environment Is Not Favorable for the Pharmaceutical Industry

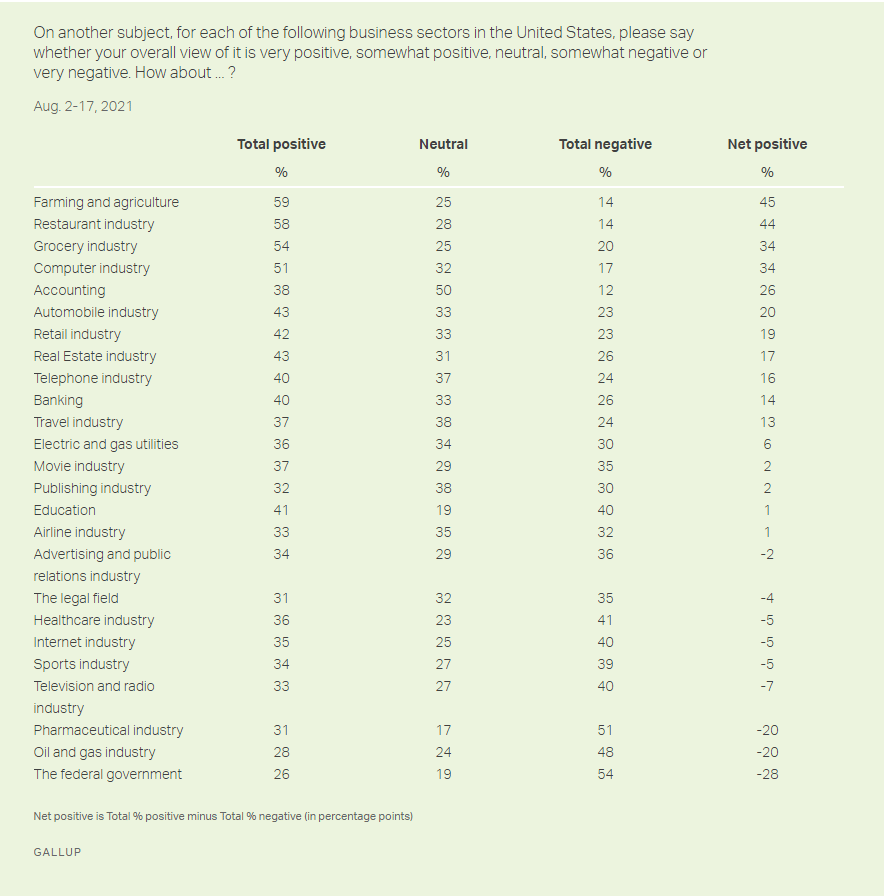

The pharmaceutical industry is the most hated industry in America…

Every year, the Gallup Poll asks respondents to rate their feelings about business sectors in the United States. In the most recent survey for which statistics are available, only one “business sector” was viewed more negatively than the pharmaceutical industry… the federal government.

And what happens to be the number 1 reason that Americans have such a hatred of the industry?

High Drug Prices…

A recent finding by the Brookings Institute found that U.S. consumers bear the brunt of the burden for revenue and profits for big pharma. It is estimated that between 64 and 78 percent of the industry’s profits are a direct result of the prescription pricing in the United States:

It is with this backdrop that our lawmakers are feeling pressure to act.

The Headlines Scream from the Hill

U.S. lawmakers seek answers on ‘troubling’ drug price increases | Reuters

U.S. lawmakers introduce eight antitrust bills aimed at drug prices | Reuters

What you should know about drug price reform: Shots – Health News: NPR

Topline Messages for Senate Prescription Drug Pricing Reforms – FY22 Budget Reconciliation

Congress Has Begun to Act…

The recently passed Inflation Reduction Act has many provisions that may negatively impact the forward profitability of the pharmaceutical industry. Here are two of the several that will have a very direct impact.

Power of Negotiation

One such provision is that it empowers the Secretary of Health & Human Services to negotiate drug prices for Medicare patients. Along with this power, there is a closed “rogue Secretary” loophole. There is a requirement that the Secretary negotiate the maximum drugs each year.

Inflation Rebate

The bill institutes a new “inflation rebate” under Medicare. If any drug cost increases higher than inflation, the notes suggest that all of the top 10 pharmaceutical companies will be required to pay back the difference to Medicare. Although inflation is high, the Federal Reserve is obviously taking steps to get it under control which will only work to hasten the returns in this industry.

These two things alone could be a big blow to profitability in the pharmaceutical industry in the years ahead.

From an investment standpoint, I do not like the current regulatory environment.

It might be possible that the full impact of these changes has not been fully realized in the share prices of the top 10 pharmaceutical companies.

What Should You Do Instead of Investing in Big Pharma?

I understand the desire to invest in the pharmaceutical industry. Achieving yield is important, and the industry offers that. I understand that looking in the rearview mirror at 11% annualized returns appears attractive. But this can potentially be achieved in other ways. Just take a look at how US companies are poised to take advantage of the arbitrage opportunity in natural gas.

For more information on where I invest to achieve yield from undervalued companies, please contact the trusted advisors at Dupree Financial Group. Or better yet click here to receive the ultimate guide to Value Investing Redefined.