You think you are finally ready to go retire!

Congratulations….

You have worked your entire life and you are reaching the finish line.

The daily grind is coming to a close and you are excited to finally go into the office tomorrow morning and just… go retire.

Out for Summer, out till Fall, you just don’t want to go back (to work) at all…

Finally, you can have peace in your daily life and slow down.

Relax…

Vacation…

And well-deserved rest…

It sounds great, but before you go retire tomorrow morning (or even the next), take a minute to consider these 3 things before you make a potentially big mistake.

Continuing to work later in life might better for your longevity, as well as your mental and financial health.

You Might Live Longer if You Don’t Go Retire

A 2016 Study from Oregon State University found that healthy persons who worked just one year beyond 65 had an 11% lower risk of death from all causes compared to those who retired at 65.

This may seem slightly skewed because one reason people retire early or as soon as possible is because of health concerns. This study removed that bias. Even people that were unhealthy yet delayed retirement for one year had a 9% lower risk of death from all causes.

Same Pattern Emerged

The healthy group were advantaged in terms of wealth and lifestyle but taking those factors into account the same pattern emerged.

Working just one year past the traditional retirement age of 65 had enormous health benefits.

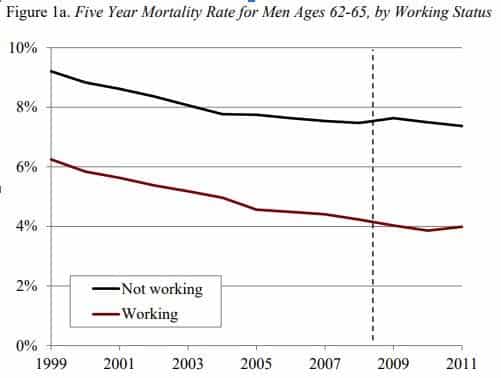

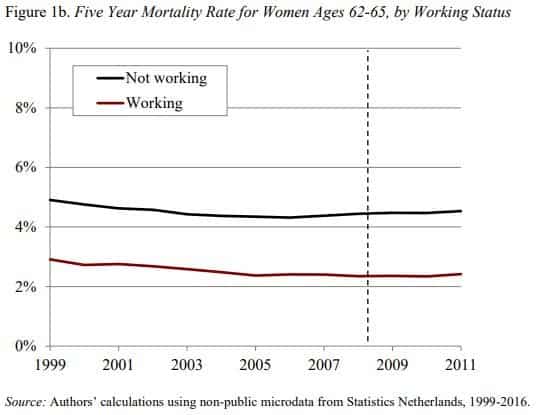

Furthermore, a 2018 study by the Center for Retirement Research at Boston College, found that working longer decreases mortality rates by 32% when compared to those that retired at the “normal” retirement age.

This study was conducted in the Netherlands and specifically examined the five-year mortality rate of men and women whose age was between 62 and 65. In both populations, the figures were eye-opening and showed unequivocally that our average life expectancy increases by delaying retirement.

3 Times More Likely to Report Being in Good Health

In yet another study in 2015 by the CDC, it was found that people who work past age 65 were about 3 times more likely to report being in good health, and half as likely to have serious health problems. Although this doesn’t take into account the fact that being unhealthy might be the cause of their retirement, it is alarming, nonetheless.

It is evident that working longer does not take away from your life. Rather, it adds to it….in years of living.

Your Mental Health Might Deteriorate Quickly if You Retire While You Are Still Young

Another great reason to continue to work past the traditional retirement age is to preserve your mental health.

We have all seen this firsthand with our former coworkers, our relatives, and our friends. When people retire, oftentimes, they lose a sense of purpose. They tend to sleep in, move slower, and think slower. For lack of a better term, they get old. Now, this isn’t true in every case. If they stay active in other ways, their mind stays strong. But when we don’t have another purpose, we can become lost.

Retirement has a detrimental effect on cognitive functioning. When we stop working, so do our brains.

Use it or lose it…

A recent study by the University of St Andrews found that we lose an average of 1 point on our cognitive scores between the ages of 61 and 67.

What happens when the sample is segregated between the retired and non-retired persons?

The working group saw some loss in cognitive scoring, but it was approximately 50% less than the retirees as a whole. Additionally, the research found that these impacts were shown throughout the group after they eventually did retire for a minimum of five years.

Chinese Rural Pension Program

Additionally, China implemented a rural pension program that supplied a stable income to participants who chose to retire at the age of 60 back in 2009.

Those who chose to participate in the program and retire at that age showed a 1.7% decrease in their IQ compared to those who chose not to participate and rather continued to work. This is the equivalent of a 3-point drop in IQ.

Alarm Bells…

The most alarming part of the study of these participants experienced delayed recall. They had a much lower ability to recall something that was said just a few minutes earlier compared to those who continued to work. This phenomenon is linked to early onset dementia.

Early retirement is linked to early onset dementia.

So, before you go to retire, consider the negative impact that it could have on your mental health. Cognition, and early onset dementia are not so loosely connected to clocking out for good.

Your Financial Health Depends on You Continuing to Work

When looking at retirement, quality of life is extremely important. And that quality is most certainly tied to our finances. In addition to social security income, you have likely saved into your company’s 401k or saved as much as you could have.

But is it enough to provide the quality of life you want to enjoy into your golden years?

Delaying Retirement 3-6 Months Reaps Huge Rewards

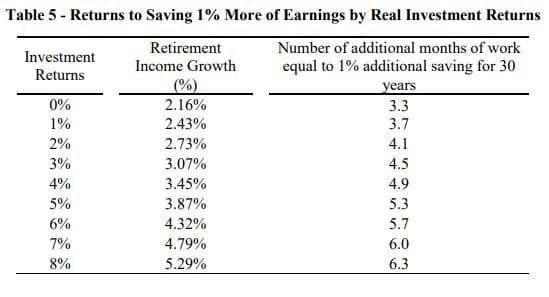

A working paper by the National Bureau of Economic Research, NBER, found that delaying retirement by just 3-6 months has the same impact on a person’s retirement standard of living as having saved an additional 1% of salary for the previous 30 years.

This is powerful…

If you would continue to contribute to your company’s retirement plan, or to your self driven plan at the same rate you are today, for just six more months…

You could dramatically increase your standard of living post retirement and also increase your ability to give like you never dreamed possible.

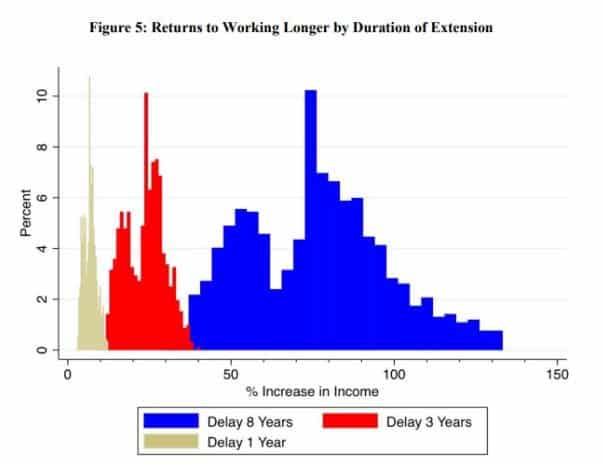

And it gets even better the longer you work past “standard” retirement age.

Delaying retirement for a full year might increase your post-retirement income by upwards of 10% annually.

Delaying it 8 years could increase your retirement income in excess of 100%.

This is especially true in the current inflationary environment. It might be time to take a moment to breathe as the fed raises interest rates to combat inflation.

Talk to a Retirement Specialist

The figures are obvious, your financial health and your legacy in retirement are greatly positively impacted by delaying retirement.

Most importantly, before you go to work tomorrow with the intent to retire, contact a financial professional that has the heart of a teacher. Our value driven approach to investing can be a tremendous help as you plan for retirement and derive income from your years of hard work.

Are your goals aligned with your investment portfolio? Contact Dupree Financial Group, LLC today for a no hassle, no obligation assessment of your plan. We are here to help.

While you wait, feel free to enjoy this complimentary look at our value driven process and download our report Value-Investing Redefined. You and your money will be glad you did.