I know it is tempting to try to be and expert in market timing, and try to sit this market out for a while, but what actually happens to investors?

When the market is up… we buy, buy, buy!

And, when the market is down… we sell, sell, sell!

The market is in turmoil, and volatility is extremely high.

For most of us, this time of turmoil makes many want to sit the market out and wait, but… what are waiting for?

And, why?

Many market timers look to certain market metrics to outsmart the market.

Others rely on gut feelings.

And the rest… They just get scared and go away for good.

The reality might be that staying in the market is the best course of action after all.

In today’s article, we’re going to explore the three main reasons why market timing doesn’t work.

Reason #1: Market Timing Metrics Do Not Accurately Show the Inflection Points

Here is one thing I hear all the time:

I will just wait for the market to bottom, then I will get back in.

I understand this thought. The market feels like it is just going to fall forever. There is a gut-wrenching feeling at the end of every trading session. Fear has set in. And you just want to sit on the sidelines and wait for the pain to be over. Then, and only then, you will start getting back to investing.

This does not tend to work, because…

It is impossible to truly know the bottom and even more impossible to know the actual top while you are in it.

For seasoned long-term value seeking investors that do extensive research on their own equity holdings, it is possible to know from your valuation models and from the information available that a particular company is over or undervalued.

If you aren’t completely devoted to these efforts, it is imperative to have a trusted advisor do the research for you.

Otherwise, retail investors do a less than stellar job of exiting and entering individual equities let alone timing the market as a whole.

Individuals tend to sell at the worst possible time and buy at an even worse time. But even the most seasoned traders still insist on trying to time the market as a whole. One very specific tool that seasoned investors utilize to time the market is the VIX volatility index.

VIX Volatility Index

The Fear Index

The VIX volatility index is also known as the Fear Index and is a measure of the Implied volatility in derivative instruments (puts and calls) looking forward 30 days. I won’t get into the specific calculations of the VIX, but it measures the market’s expectation of how quickly the underlying index might change in price in the near term.

Volatility increases the risk premium that investors should require on their holdings, and all other things being equal, should necessitate a decrease in equity prices (unless it is the current market for natural gas). Therefore, a rising VIX should coincide with a decrease in prices.

Market timers should therefore want to sell their holdings when the VIX is really low and buy when the VIX is really high. In theory this sounds great. However, the really high becomes extremely subjective. As discussed in this episode of the Tom Dupree Show, the most recent market bottom in June saw a VIX in the mid 40s. This is much, much lower than we have seen in multiple market bottoms. Many investors would have missed this recent strong rally waiting for the VIX to reach 80 before jumping back into the market. Therefore, this form of market timing does not work very well.

Reason #2: Investors Behave Irrationally and Actively Un-Time the Market

There are several studies on market timing, but this alarming statistic certainly restates the thesis.

The average index fund investor during the 20-year period from 2000-2020 earned 5.96% annualized, whereas the average annualized return from the same index fund basket over the exact same period exceeded 7.4%.

Is this a fluke?

No, the reason for this underperformance was largely attributable to individual market timing, good and bad. Redemptions at the worst time and sitting on the sidelines waiting for a correction were the culprits. Preparing for corrections is expensive!

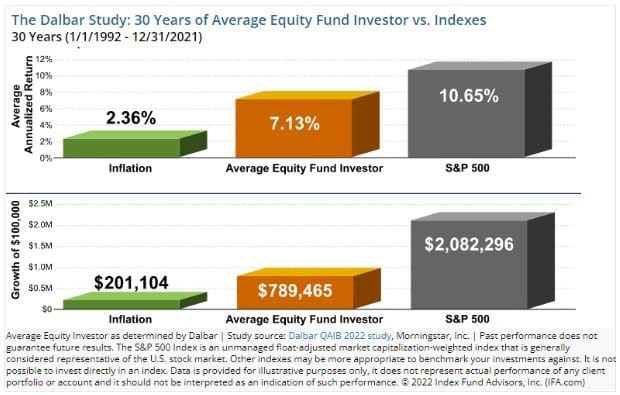

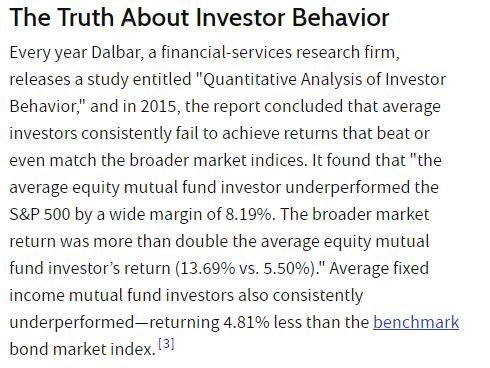

An even more alarming study entitled “Quantitative Analysis of Investor Behavior” shows the impact of market timing. This study shows that average investors consistently fail to achieve returns that are even close to matching the performance of broader market indices.

In their most recent study, they looked at how investor market timing behaviors have contributed to performance. $100,000 invested 30 years ago would have grown to $2,082,296 had an investor just left their money in the S&P 500 index. However, due to behavioral characteristics, the average equity fund investor missed out on nearly $1.3 million in value because they try to outsmart the market or experience both panic and greed.

Before you try to time the market, consult a professional, your peace of mind in retirement may very well depend on it.

More Evidence

Dalbar research firm releases the QAIB report every year. This report studies investor behavior and its impact on actual investor returns over long periods of time. The report issued in 2015 showed the following:

Staying in the market blindly during this time would have resulted in a far superior return than the wait and see approach.

Reason #3: Time in the Market Beats Timing the Market

The legendary value investor, Peter Lynch, who managed the Fidelity Magellan Fund from 1977-1990 famously outperformed the market during his stint at its helm. He achieved an average annual return exceeding 29% during this run. He had this to say with respect to market timing:

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” –Peter Lynch

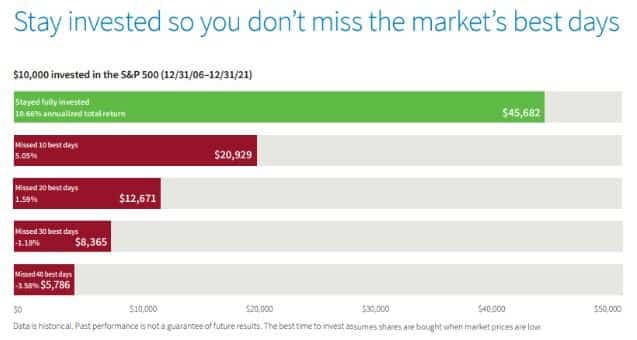

And the numbers back it up!

Had you invested $10,000 in the S&P 500 at the end of 2006 and left it fully invested for 15 years that investment would have grown to $45,682. However, if you practiced market timing and missed only the 10 best days during this timeframe, the value would have only grown to $20,929. You cannot know ahead of time when those ten days will happen. Don’t miss those ten days over the next 15 years.

The goal is not to “beat the market” but rather to reach or exceed your personal goals.

This is the crux of what we do every day for our clients at Dupree Financial Group, LLC. We want to help investors like you reach or exceed your personal goals.

We do this through performing due diligence in everything in which we invest. Our value-driven approach to investing starts with extensive research, and hard work. These efforts are what propel us as a firm and help our clients stay in the market when others are fearful. It is what we do every day.

Time in the market trumps market timing for even the most knowledgeable investors. You cannot accurately predict the absolute top, or the absolute bottom of any cycle. Many have tried, and almost all have failed. In retrospect it is easy to see the peaks and valleys but looking straight ahead you cannot.

Don’t miss out on the best 10 days in the next 15 years.

Just as Peter Lynch so eloquently stated, “Far more money has been lost by investors preparing for corrections, than has been lost in corrections themselves.”

Contact us today for an absolutely free, no-obligation look at your personal investment strategy and goals. Or enter your email and get our free guide: Value Investing Redefined.