Did you know that some equity sectors actually perform very well in the inflationary environment we find ourselves in today.

Location, location, location…

We’ve all heard this phrase before.

The location of your business can determine its success.

Locate your business where there is no population, and your chance of success greatly decreases. If your business relies on foot traffic and you find a great deal on a retail location in Bono, IN (population 758), success may be hard to find. It really doesn’t matter how pretty the layout of the store is… no customers, no money.

The same thing is true with investing in the stock market. You might not want to invest in businesses that are very dependent on consumers when the consumer has vanished. They may very well come back at some point, but it will be a tough road to hoe at least for the time being. It is important to be aware of the economic climate.

Today we find ourselves in the midst of the highest level of inflation we have seen in over 40 years.

Will this climate be everlasting?

We don’t believe that it will! We believe inflation will ultimately take care of itself if our leaders will let continued improvements in technology increase domestic productivity.

However, it is very important to have a firm grasp on the current inflationary environment to grow our clients’ wealth during these uncertain times.

Do you want to know a dirty little secret?

The inflationary environment in which we currently find ourselves is actually very good for at least these 10 sectors of the US stock market.

And we are still finding value in these locations of the US economy for our clients today.

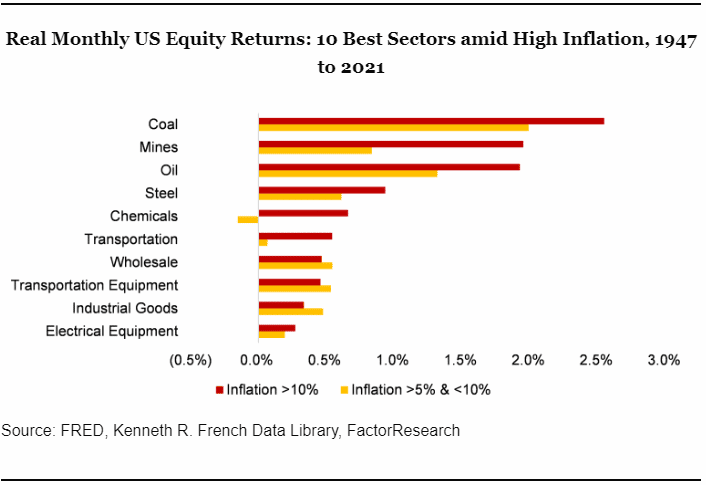

10 Best Sectors in Inflationary Environments

There are at least ten sectors that could provide big wins for equity investors during periods of high inflation.

These include the Coal, Mines, Oil, Steel, Chemicals, Transportation, Wholesale, Transportation Equipment, Industrial Goods, and Electrical Equipment Sectors.

There is an enormous volume of statistical information from the end of World War II to today. And this data indicates that these ten sectors actually win during periods of high inflation.

Of these sectors, 9 have positive real monthly average returns when the rate of inflation is between 5% and 10%. Furthermore, all ten have average positive real monthly returns in periods in which inflation exceeded 10% annually.

In this inflationary environment, we continue to find many companies in these sectors that provide tremendous value for our clients. Furthermore, the recent pullback makes them even more attractive.

For the purposes of this article, we will highlight one such company: Kinder Morgan, Inc. (KMI).

Kinder Morgan, Inc. May Be Well Positioned in This Inflationary Environment

In our years as financial advisors, we have always hung our hat on fundamental research. We have a firm grasp on the value-added propositions of each and every company in which we invest on behalf of our clients.

One such company that certainly fits the bill in today’s climate, and quite frankly most economic climates, is Kinder Morgan, Inc. The company is a large energy infrastructure company. It is exposed to the oil sector, but they are essentially a transportation company. The equity is exposed to two sectors that have done well in past inflationary environments.

They own an interest in and/or operate approximately 84,000 miles of pipelines and 157 terminals. These pipelines transport natural gas, refined petroleum products, crude oil, condensate, CO2 and many other products. The company is focused on cash flow and makes money for our clients by charging fees for the use of its infrastructure.

In addition to the sector, there are several things we like about this specific company.

The Company is No Longer Organized as an MLP

One thing we like about Kinder Morgan is it is now structured as a C-Corp.

If you owned Kinder Morgan in the past, you may remember the company being organized as a master limited partnership (MLP). When the company was organized in that fashion, it was a bit unwieldy for individual investors. When you own an MLP, you receive a schedule K-1. You may have received a K-1 if you have participated in an investment club or received a distribution from a trust or estate. When the company was organized in this fashion, investors would be required to file an additional form with the IRS each year. Also, when you sell the shares of an MLP your cost basis was continually written down. So, owning it was a cumbersome process.

MLPs Rely on Debt

Most of the time, these companies distribute 100% of their cash flow directly to shareholders. These companies tend to rely on the issuance of debt and/or dilution of equity to fund growth opportunities. It can be much better for a company to rely on its cash flow or retained earnings to fund such growth.

Back in 2014, Chairman and CEO Rich Kinder made the bold and necessary decision to reorganize the company as a traditional C-corporation. He acknowledged that the company was having a difficult time taking advantage of lucrative midstream growth and acquisitions opportunities. This was largely due to its organization as an MLP. The cost of capital was hovering around 12%. By organizing the Kinder Morgan entities differently, the restructured company would be better positioned to take advantage of these opportunities.

And it has worked…

The company is no longer reliant on the issuance of debt or equity to fund its ongoing operations and strategic opportunities. And investors are no longer receiving cumbersome K-1s that they must file every year with Uncle Sam.

What else do I like about this company?

KMI is Well Positioned for Growth Due to Russian Aggression

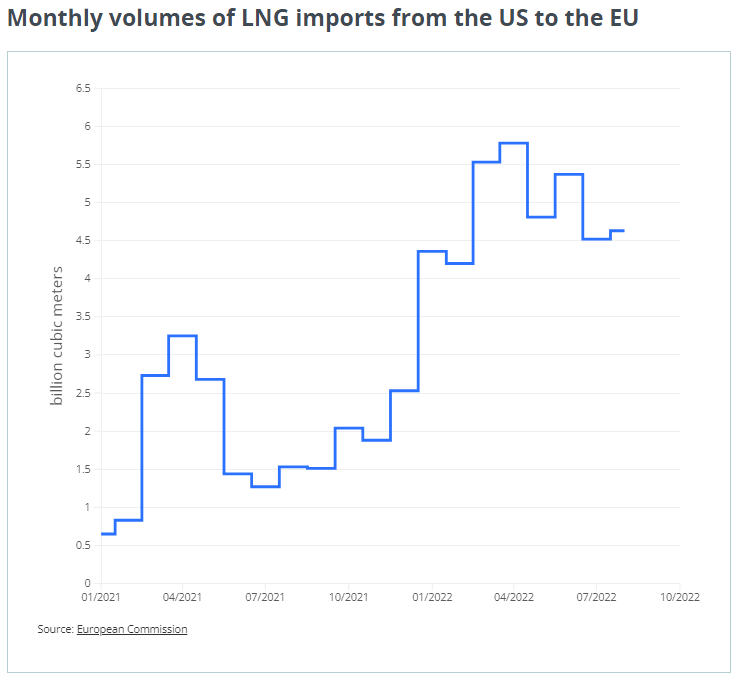

We have written a bit on this topic in the past, but it is worth mentioning again. Since Russia’s invasion of Ukraine, the EU has had to search elsewhere for the supply of Natural Gas. And US companies are very well positioned to supply this gas.

We have the infrastructure to supply this much needed commodity, and this in very large part to the exact pipelines that Kinder Morgan owns and operates. This could prove to be a tremendous boon to shareholders.

How is this a boon?

Kinder Morgan, Inc. does not have much direct exposure to minor fluctuations in the pricing of the commodities that pass through its pipelines. Rather they collect a small fee for everything that is transported through its system. So, any increase in the volume that passes through its gates will result in additional cash flow that will impact its bottom line.

What’s Next?

KMI is currently expanding its ability to service this increased need. They recently announced an investment in the Permian Highway Pipeline. This should result in an increase in capacity of approximately 550 million cubic feet of natural gas per day by the Fall of 2023.

We certainly like what we see coming down the pipeline with this company. But what we like even better is cash flow.

And guess what…

This Company Provides Solid Income to Its Shareholders

When the company reorganized itself as a C-corporation, it did so to have the opportunity to retain cash flow to fund its growth. So, quite obviously, it dramatically cut its dividend at that time. The dividend was reduced to $.125 per quarter in 2016. Since that time, however, the company has grown its dividend each and every year. Now, the company boasts a quarterly dividend of $.2775! The dividend has more than doubled in the past 6 years.

With the opportunities that the company is able to seize upon we believe this trend of dividend growth could continue for the foreseeable future. This is certainly favorable for value-oriented investors that seek income and distributions to fuel their retirement.

Invest With Dupree Financial Group

Research is at the heart of everything we do as a firm. It is this research that gives us the confidence to weather any storm and make the sea of investment as calm as possible.

Kinder Morgan, Inc. is just one of the many opportunities we find in today’s inflationary environment. To learn more about our firm or other opportunities we have uncovered that could fit nicely in your portfolio contact us for an absolutely free no-obligation look at your investment portfolio. It never hurts to get a second set of eyes on your portfolio.

Dupree Financial Group, LLC makes no representations or warranties about the accuracy or completeness of the information provided in this article. No information provided by Dupree Financial Group, LLC, is intended as securities brokerage, investment, tax, or legal advice. As with all equity investments, there is a risk of loss, and you should perform your own due diligence before investing in any equity.