Will an improvement in production technology get inflation under control?

Inflation, Inflation, Inflation…

It is everywhere.

You feel it at the pump.

It screams at you at the grocery store

We are all feeling the pinch…

And, now, the Federal Reserve tells you to expect more “pain” as they try to tame it.

Prognosticators are suggesting that we might be entering an era of low economic growth coupled with high inflation.

But this time is different!

In this article I will explore how investment in production technology has played a critical role in keeping inflation under control for the past several decades and continues to even today. And I will briefly explore how further investments in production technologies should continue to keep inflation at bay in the future.

Maybe, just maybe, the Federal Reserve should stay away and let technology save the day again!

Past Improvements in Production Technology Have Kept Inflation Low

In the past, improvements in production technology have worked to keep inflation at bay. This is why we have enjoyed a long sustained period of low inflation despite extremely low interest rates and relatively low unemployment.

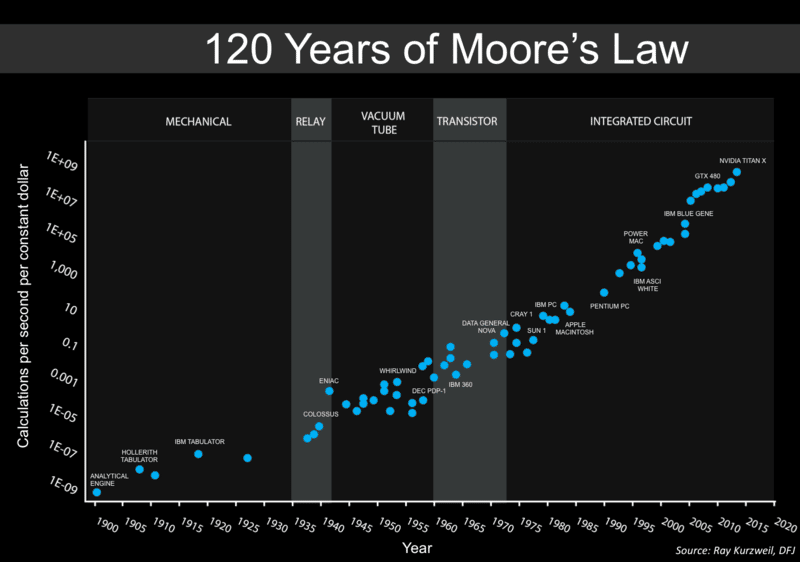

We have enjoyed a continued increase in computing power. Back in 1965, Gordon Moore made an observation that became known as Moore’s Law. He recognized, through observations with Fairchild Semiconductor, that the number of integrated circuits able to be placed on an integrated circuit chip would continue to double every two years. And that the resultant raw computing power would grow exponentially forever.

Computing Power Has Gotten Cheaper Over Time

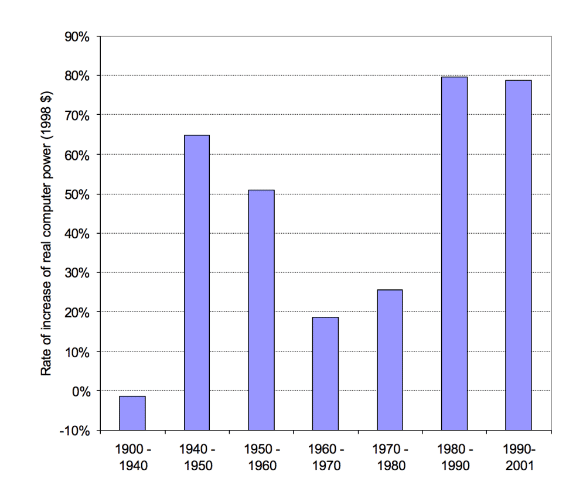

Simultaneously, and not circumstantially, the real value of computing power has increased at an extremely rapid rate over the past 50+ years. Raw computing power per dollar has averaged an increase of about 60% over the past quarter century.

This has resulted in a bigger bang for the buck for investment in production technology. About every four years during this timeframe, the computing power for each dollar of investment has increased by a factor of 10.

This rapid expansion in computing power has had a deflationary effect on manufactured goods. Since the end of stagnation in 1982, the average annual inflation rate has been 2.84%. This is despite the fact that from 1982 – 2021, the total money supply (M2) has grown from $1.757T to $19.404T. This is a continuous increase in the money supply of roughly 6.18% annually.

Undoubtedly, there are other contributing factors that work to explain the difference between the growth in the money supply and the actual realized rate of inflation. However, the productivity gains realized from investments in production technology are most undoubtedly deflationary.

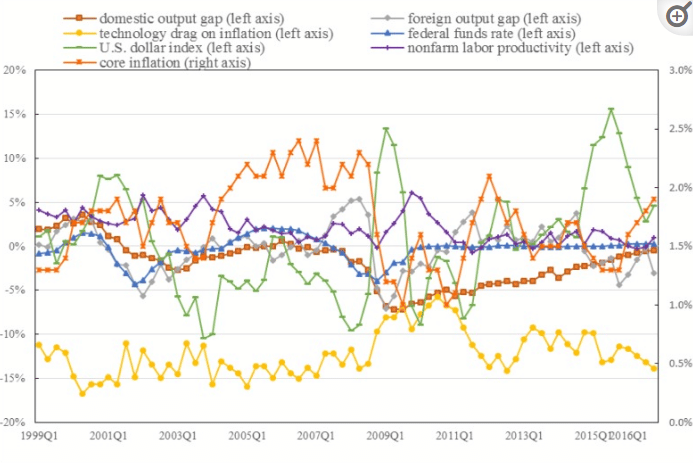

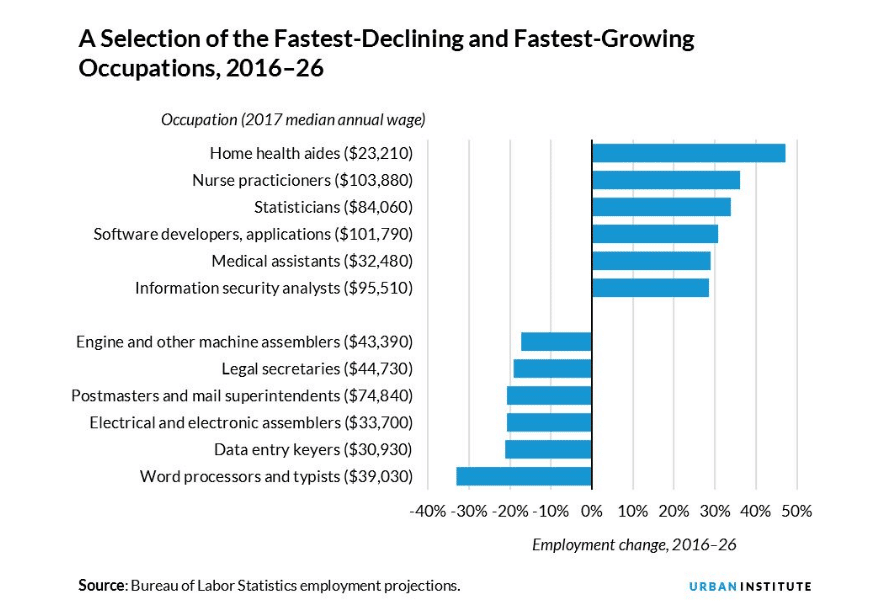

In fact, the deflationary impacts of technology have been such a concern in the US that the Federal Reserve has had a difficult time maintaining its goal of 2% inflation. For the past decade, despite the rapid increase in the money supply and the extremely low Fed Funds Rate, real inflation in the economy was below the target of 2% for six of those ten years. As can be seen in the chart above, technology has had a drag on inflation to the tune of 5-17% from 1999 – 2019.

From Where Have the Savings Come?

Improvements in Production Technology decrease labor costs.

In a recent study by MIT Economist Daron Acemoglu, it is noted that adding one additional robot per 1000 production workers lowered the labor participation rate by about .2%. If this figure is accurate, it means that one automated input in the production process displaces approximately 3.3 workers.

Additionally, this works to reduce inflation because it also creates a negative wage effect as well. The ability to replace workers with automation has led to a decrease in the average wage by approximately .4%

Workers will likely continue to be replaced by automation. Although painful to many, this will certainly continue to have a dampening effect on inflation.

We have certainly lived through an environment of robust growth in automation and technological revolutions in the recent past. Moore’s Law has proven to be a boon to productivity and a bigger bang for the buck.

But, is it over? What are companies doing today with their investment dollars in production technology to continue to reap the benefits of lowered costs?

Current Investment in Production Technology

In the current inflationary environment, industry leaders continue to invest heavily in production technologies that will create value for shareholders. These investments should continue to be deflationary for the economy as a whole.

From 2018 – 2021, several areas of the technology space have seen large increases in spending amongst producers. These areas include, but are not limited to, Industrial Machine Learning (IML), SCM mobile technologies, applied artificial intelligence and quantum computing.

Industrialized Machine Learning

Machine learning is the study of algorithms and statistics that computers use to perform a very specific task without the use of explicit instructions. For that reason, it is sometimes seen as a subset of artificial intelligence. This promising technology continues to see a growth in investment as a result. From 2018 to 2021, investment in this deflationary technology has grown 150% from $2 Billion to $5 Billion.

Future of Mobility

Advancements in mobility technologies have proven their efficiency. This technology reduces the overall cost to transport goods throughout the supply chain. This area of technology has seen investment growth from $139 Billion in 2018 to $236 Billion in 2021.

Applied AI

Applying artificial intelligence to the production process promises to enable producers to solve problems before they arise. This lowers downtime and creates the ability for a more efficient production environment.

Manufacturers appear to believe in this technology, as corporate spending in this area has grown from $66 Billion in 2018 to $165 Billion in 2021.

Quantum Technologies

Quantum based computing technologies are still very new. The power of quantum computing has the possibility to revolutionize the way problems are solved in the future. In 2021 $3 Billion dollars was invested in this technology.

Future Investments in Production Technology

There are two large areas of technology that show extreme promise in the future and deserve special attention. The investments are pouring in and will reap huge rewards for patient, long-term investors.

The Future of AI in Production Technology will Continue to Provide Deflationary Pressure

Artificial intelligence (AI) is the ability of a digital computer or computer-controlled robot to perform tasks commonly associated with intelligent beings. Investment in this area will reduce labor costs and increase the efficiency of production.

By 2030, investment in AI technology is expected to reach 1.5 trillion dollars. Expenses in AI production technologies are already paying off in a big way.

According to the 2021 McKinsey global survey on AI, 27% of companies surveyed report that at least 5% of their earnings are attributable to AI investments. This represents an increase in over 20% from the previous survey and this looks to continue to increase, as these case studies indicate.

Case Studies on AI Investment:

The impact of AI has proved to be a game changer for Danone Group. This French food manufacturer uses artificial intelligence and machine learning to improve demand forecasts. This has led to a 20% decrease in forecasting errors and a 50% reduction in agent workload (possibly resulting in future decreased labor costs). The company also notes that this has resulted in a 30% decrease in lost sales.

Auto Manufacturers Invest Heavily in AI Technology

Porsche continues to benefit from their investments in AI production technology. The company uses autonomous guided vehicles to increase productivity in its automotive manufacturing process. In the production of its Taycan model, Porsche utilizes AI in its production line, Flexi-Line, which works to cut down on direct labor costs.

BMW Group also continues to reap benefits from its production technology investments in AI. The company utilizes image recognition to automate the inspection of its vehicles throughout production. This enables them to decrease the costs of its final products by immediately recognizing and eliminating even the smallest deviations from its targets.

Another Mckinsey report backs this up reporting that AI improves forecasting accuracy in manufacturing by between 10 and 20 percent. This translates to an increased efficiency in inventory management costs approximating 5%. It also works to increase revenues in excess of 2%.

There are immense benefits from continued investments in AI. Companies, large and small, are increasingly realizing productivity gains from it. This is one reason why the future is bright on the inflation front. Artificial intelligence will likely continue to be a deflationary force for years to come.

Quantum Computing: A Bright Future Investment in Production Technology

One reason that many have been slightly fearful about the continued effects of Moore’s Law is the physical limit of the integrated circuit. We are reaching a time whereby it will become extremely difficult for the existing microchip to continue to double the number of transistors per surface area. As such, what additional productivity benefits can the existing model provide for investors in the future?

The answer might just be found in quantum computing.

Vishal Shete, Head of Quantum Value Creation at Sia Partners said this in reference to quantum computing:

“It’s important to remember that comparing a classical computer to a quantum computer is essentially like comparing a candle to a lightbulb or bicycle to a jet plane.”

I won’t go over the reasons and calculations about why quantum computing could reap enormous benefits for production technology and have revolutionary impacts on future inflation.

I will just repeat this one statement:

“It (quantum computer) is a device so powerful that it could do in 4 minutes what today’s supercomputers currently would take 10,000 years to accomplish.”

The creation of quantum machines could be a total game changer in the field of manufacturing technology. I could foresee a dramatic increase in efficiency and decision-making capabilities with this amount of power at the fingertips of decision makers.

How Can You Benefit from Improvements in Production Technology?

These continued advancements in technology should continue to handsomely reward investors.

To properly position yourself and your portfolio from these continued deflationary impacts, you need to enlist the help of a financial advisor that dedicates their professional life to research.

And research is at the heart of everything we do to make money for our clients.

Contact Dupree Financial Group today to see how you can benefit from our research. We will help you grow your wealth. We uncover the companies that benefit from productivity gains that continued technology investments provide. You owe it to yourself to get a fresh set of eyes on your portfolio.

Contact us today.