There is a huge and obvious arbitrage opportunity in natural gas…

Can US companies capitalize?

As the song goes…

War, huh, yeah

What is it good for?

Absolutely nothing…

Well nothing except for natural gas prices in Europe!

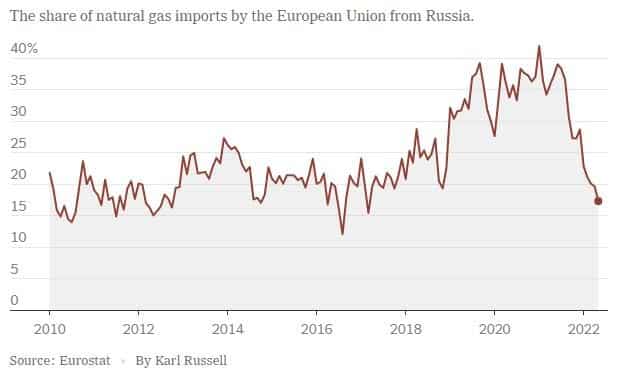

Since Russia’s invasion of Ukraine, the percentage of natural gas that Europe receives from Russia has been halved from approximately 40% of its annual consumption to now less than 20%. This loss in supply must come from somewhere, but where?

The good ole US of A, that’s where.

And we have the infrastructure and the supply to take advantage of what has become an arbitrage opportunity.

Enormous Spread Has Created an Arbitrage Opportunity

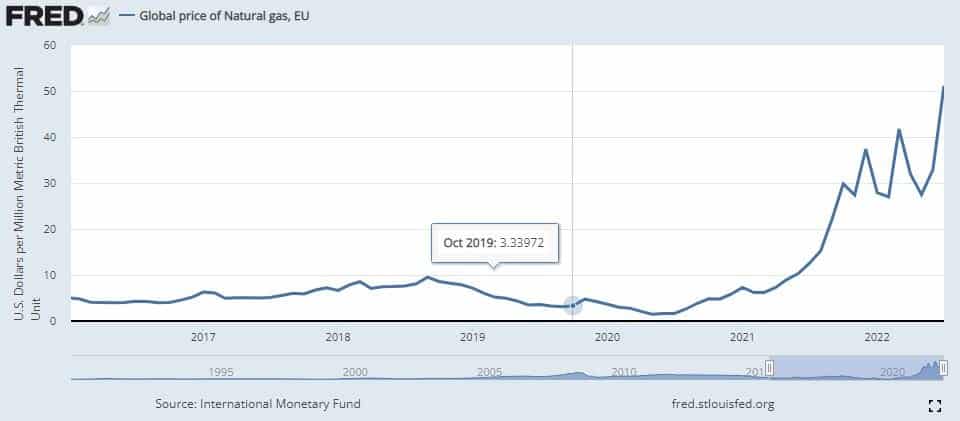

There has almost always been a spread between the pricing of natural gas in the US and Europe. But take a look at what has happened since the outbreak of the war that Russia has initiated with Ukraine.

The day of the invasion on February 24, 2022, the price of gas in Europe soared as much as 62%. And the price has only soared since.

As tensions started to rise between Russia and Ukraine, the price of Natural gas was already trending up from around $10/MMBtu. The day of the invasion, the price spiked from about $26/MMBtu to $41/MMBtu As of July 2022, the price had further risen to in excess of $51/MMBtu. On August 26 the price of LNG continued its upward spike despite Fed rate hikes designed to combat inflation, this time hitting $74.49/MMBtu.

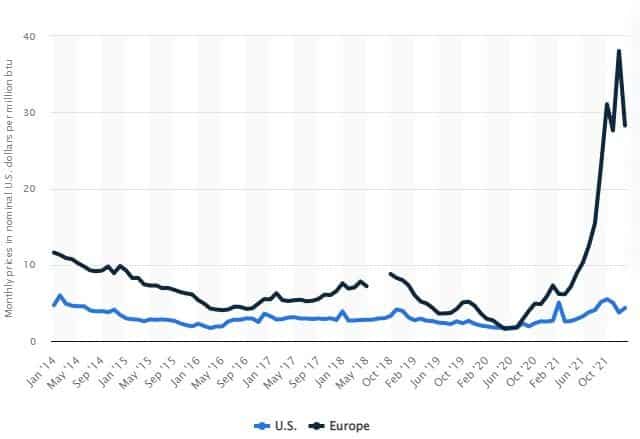

The spike in pricing in European markets has stimulated pricing in the United States as domestic producers have an increase in quantity demanded in Europe. But there is a widening spread between the market price in the US and European nations as can be seen in the following graph.

As of the close on September 14, 2022, the price of natural gas in the United States was $8.69/MMBtu. In the Netherlands, the most liquid natural gas market in Europe, the price of LNG closed for $60.81/MMBtu.

There is definitely energy lost in the conversion of natural gas to LNG, and there are shipping costs associated with transferring the LNG across the pond. Despite these losses, the spread is wide enough to more than offset them.

The United States Has the Supply to Take Advantage of This Hedging Opportunity

As mentioned, the supply of natural gas from Russia to all of Europe has plummeted during its war with Ukraine. Russia was the largest supplier of natural gas to Europe supplying in excess of 40% of its supply roughly 155 billion cubic meters in 2022 which converts to 5.47 trillion cubic feet.

Who can replace that supply?

Several countries have the reserves to offset this loss of supply. The EU has been working to offset this supply by year’s end. An EU spokesperson said, “We are also working together with other alternative energy suppliers such as the USA, Qatar and Azerbaijan, to give just some examples.”

The USA is well positioned to meet this demand. We have a huge supply. Our proven reserves at year-end 2020 stood at 473.3 trillion cubic feet. Also, The U.S. Energy Information Administration estimates in the Annual Energy Outlook 2022 that as of January 1, 2020, there were about 2,926 trillion cubic feet of technically recoverable resources (TRR) of dry natural gas in the United States. Domestically, the United States produces about 30 trillion cubic feet annually. At that rate, the US has enough natural gas to last about 98 years. Assuming the same annual rate of U.S. dry natural gas production in 2020 of about 30 trillion cubic feet, the United States has enough dry natural gas to last about 100 years. And more than enough to offset the loss to the EU from Russia. As of the end of 2021, the entire demand by the EU stood at 14 trillion cubic feet.

The US has the natural gas to supply the energy needs of Europe, but can we get it there.

This Arbitrage Opportunity Needs Large Investments in Infrastructure

To transport natural gas throughout the country to take advantage of this arbitrage opportunity, a vast infrastructure must be in place. And the United States has it.

Kinder Morgan (KMI) engages in the infrastructure business. They operate pipelines and essentially collect money from the use of their infrastructure. It takes huge amounts of capital to get this infrastructure in place, and the US has it in droves.

After the natural gas has been shipped through this pipeline system, it then needs to be condensed to LNG for shipping. Cheniere Energy, Inc (LNG), engages in the business of liquefying natural gas as well as other competitors.

The United States has an early mover advantage when compared to other countries that have Oil and Gas Reserves.

Take a look at Poland.

Poland is a large coal producer which typically means that they would have large oil and gas reserves as well. Where there is coal there is oil and gas. So why don’t they produce much?

- Poland lacks the infrastructure

- Regulations in Europe are very tight (when compared to the US historically)

- Lack the Intense capital requirements to ramp up (and it takes years)

US Infrastructure and large spread means there is an economic opportunity in this space for domestic manufacturers.

How Can You Take Advantage of This Arbitrage Opportunity?

Invest with Dupree!

At Dupree Financial Group, LLC, we do the research. It is at the heart of everything we do. We uncover opportunities like this all the time, and we put our clients’ money to work to leverage our research for your long-term gain. Contact us today for an absolutely free, no-hassle look at your current investment portfolio and see what how Dupree can help you grow your assets for retirement and beyond.

To learn more, download our free guide Value Investing-Redefined.