If you received a capital gains distribution on your mutual fund this year, you might be screaming aloud, “How in the heck is this possible?”

We have seen what is possibly in the offing for mutual fund owners this year, and it isn’t pretty!

This is the scenario what will haunt millions of investors in the next few months:

It is February 15th…

You walk to your mailbox just like you do every day.

Then, you carry that mail to your office desk and sift through all your bills. You stumble across a statement from your mutual fund.

You open the envelope and notice a 1099-DIV statement. Your normal dividends are there, but under the heading of capital gains distribution you see a number that is… shockingly huge despite the fund being down for the year!

What is this?

How is this so much bigger than any other year? It is several times any number you have ever seen on this section of your form in the past!

What a terrible joke!

Did they make a mistake?

The mutual fund was down 20% last year, how could you possibly have a tax obligation for capital gains?

If you are like millions of other mutual fund investors, you reinvest your dividends and capital gains distributions, so you didn’t actually receive a check.

You immediately pick up the phone and call your fund.

After what seems like an eternity you get someone to explain that it is, in fact, accurate and that you owe the IRS taxes on this amount.

If you didn’t get a satisfactory answer to this question, this is the article for you.

We will explain capital gains and discuss how these are calculated with respect to mutual funds.

There might just be a better way for you to build wealth in the future!

What are Capital Gains?

If you are investing in 2022, you might need to be reminded of capital gains.

Unless you invested in the oil & gas sector in companies like EOG Resources, it has been a tough ride this year.

Capital gains occur when you sell a particular asset for more than your cost basis.

For most asset classes, this is really easy to calculate. Your cost basis will typically be what you actually paid for the investment.

Capital Gains = (Sale Price – Cost Basis)

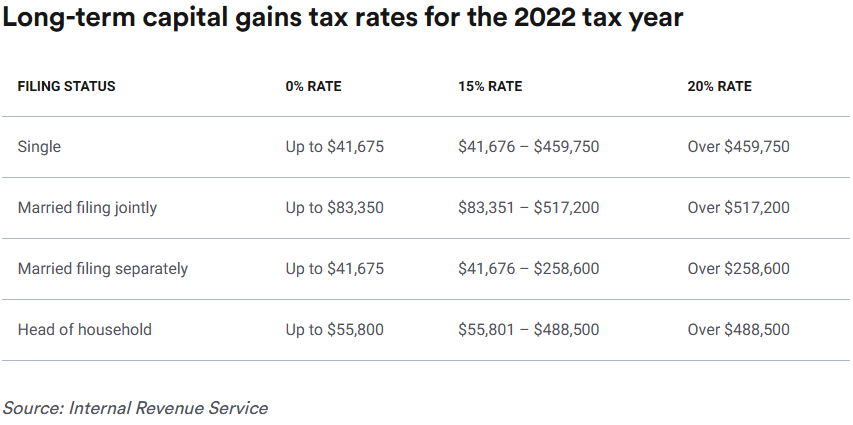

This profit is taxable income. If this asset was held for longer than one year, it will be taxed as a long-term gain at the following rates:

Capital Gains Example

Let’s say, for example, that you purchased 100 shares of Berkshire Hathaway Class B shares in July of 2020 for $200.00 per share. Then, in December of 2022, you sold those same shares for $300.00 per share. At the time you sold those specific shares, you realized a capital gain. Your investment of $20,000 had grown to $30,000 and you made a tidy profit of $10,000 in a little over 2 years.

If you are a single, hard-working woman who earned $200,000 in 2022, you would be subject to a long-term capital gain tax obligation of $1,500. And would need to pay that amount to the IRS if you held those shares outside of a tax-sheltered account.

($30,000 sale price – $20,000 cost basis) x (15% long term capital gains tax rate) = $1,500

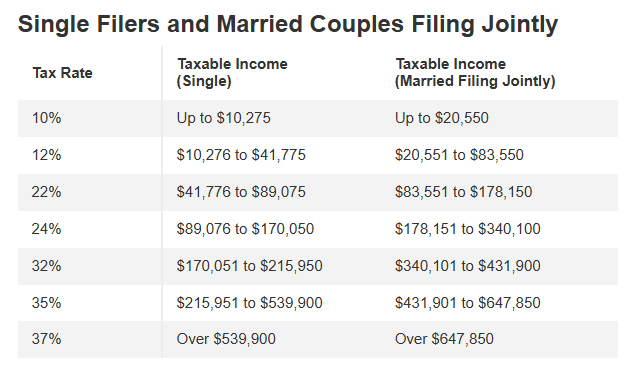

If you held that investment for less than one year, your profit would be taxed as ordinary income and would be subject to the following marginal tax rates:

Had you made the same gain on your investment in Berkshire Hathaway in a timeframe shorter than 12 months, you would owe the IRS not $1,500 but $3,200 for this transaction.

This is relatively simple!

When you sell shares of stock for more than you paid, you have a capital gain or profit. And when you make money, the IRS gets a cut.

Taxation of Capital Gains on a Mutual Fund Scheme

Much like purchasing individual stocks, when you sell or redeem your mutual fund shares you could be hit with a capital gains tax liability.

Although none of us enjoy paying taxes, this is at least understandable.

Capital Gains at Redemption

Let’s say you bought shares in XYZ mutual fund five years ago. At that time, you paid $10.00 per share to purchase 1000 shares of this open-end fund. You now decide to redeem these shares directly from the fund, and the net asset value is determined to be $12.00 per share at 4:00 PM at the end of the trading day.

Assuming you have no back-end sales load on this redemption (which you likely will), you would show a capital gain of $2.00 per share or $2,000. Since this holding was longer than 1 year and it was held in a taxable account, you would be subject to a long-term capital gains tax on that $2,000.

Mutual Fund Capital Gains Distribution

The capital gains distribution is the raw deal with the taxation of mutual funds.

Okay, so you didn’t sell your mutual fund this year when others were panicking. But you still find yourself with a tax bill.

How can this be?

When you bought those 100 shares of Berkshire Hathaway Class B shares, you knew your cost. You paid $200.00 per share. Similarly, when you buy a mutual fund, you know what you paid for the mutual fund.

It’s what you didn’t know that is coming back to bite you right where it hurts the most: your wallet.

When you decided to participate in a mutual fund, you inherited a tax liability you might just now be learning about. The fund itself had likely been sitting on a basket of equities that were worth much more than what the fund had originally paid.

And the fund will not realize capital gains until it sells that position. Furthermore, those capital gains are distributed to you (typically in December) when it liquidates that position.

It doesn’t matter when you bought the fund.

It doesn’t matter that you are down on your holdings this year.

And it most definitely does not matter what the value of that specific equity was when you bought into the mutual fund.

The only thing that matters is that the fund itself sold the position and realized the capital gain at that moment. The fund is forced to distribute those capital gains to its fund owners. And you are now subject to a tax obligation that you might not have had any clue you would be hit with.

Embedded Capital Gains Example

Let’s say that the fund had purchased those same Berkshire Hathaway shares back in 2020 for $200.00 per share, but you didn’t buy shares in the mutual fund that owned them until July of 2022. At the time you purchased the mutual fund, it was sitting on an unrealized (or embedded) capital gain of $100.00 per share on that purchase. At some point in time, the mutual fund will likely sell that position. And when it does… you will inherit a tax liability representing your portion of that holding.

Your cost basis for those shares was determined at the time that it bought the shares, not at the time you bought the fund… yuck!

To add insult to injury, it is exactly in years that the market is down that mutual funds will be more likely to make capital gains distributions.

This might be counterintuitive, but it is true, nonetheless.

Net Outflows Force Funds to Realize Capital Gains

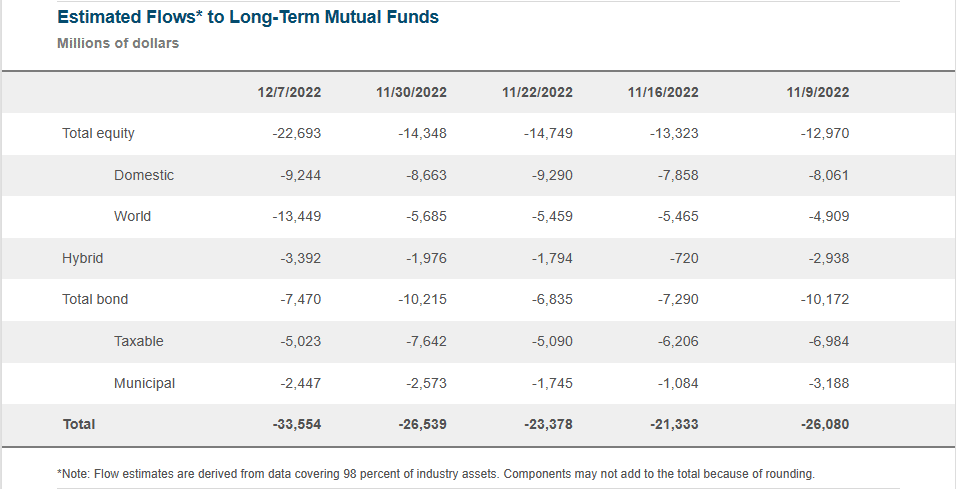

When market corrections occur, there are typically net outflows from mutual funds: redemptions increase. Looking at the data from the Investment Company Institute (ICI), net outflows from equity funds totaled approximately $22.7 Billion for the week ending December 7, 2022. And this is not an isolated event. Net outflows from equity funds had occurred each of the prior four weeks as well.

According to Citywire, the mutual fund industry is having its worst year for redemptions on record. Through the first 11 months of 2022, there have been approximately $807 Billion redeemed from US mutual funds.

The average investor is terrible at timing the market. When the value of equities or funds fall, investors fear the trend will continue and their own recency bias convinces them to sell. You might stay the course and realize that the market doesn’t go straight up.

There are bumps along the way as you chart your financial future.

The stock market goes up and down, but solid companies endure.

But many of your fellow mutual fund owners are not that strong-minded. They sell when the market is falling. If you own individual shares, that doesn’t affect your tax liability. However, when this happens inside of a mutual fund it matters greatly.

You might wonder, “Why?”

Under typical market conditions, mutual funds have enough cash on hand to pay for redemptions. In that environment, the fund can continue to maintain its equity holdings and defer capital gains. However, when there are massive outflows from mutual funds, cash needs to be raised to pay for these liquidations. So, the fund is forced to sell some of its holdings.

So, when you see headlines that read, “this is the worst year on record for mutual fund redemptions”, you could also infer that it will be a big year for capital gains distributions.

Regardless of when it eventually happens, if you are invested in a mutual fund that has had a good track record it was likely sitting on embedded gains when you bought it. At some point in the future, owners in the fund will be forced to shoulder the tax burden (if they hold the fund in a taxable account).

Embedded Capital Gains in Mutual Funds

Just how big of a deal are these so-called “embedded capital gains” in mutual funds?

It turns out it is… Huge!

Take a look at one of the largest active open-end funds, American Funds Growth Fund of America. After the close of the market on 12/16/2022, the NAV of the fund was $50.01, and had assets under management (AUM) of approximately $210 Billions. As of May 31, 2022, it was estimated by Morningstar that in excess of 64% of its net asset value was unrealized capital gains.

64% of American Funds Growth Fund of America’s NAV was unrealized capital gains!

Think about that for a moment!

I realize that the fund likely won’t liquidate everything in one year, but if you purchase one share of any fund that has that type of unrealized capital gain you are buying a tax burden.

Let’s suggest you invest $100,000 in a mutual fund in a taxable account. You didn’t realize it at the time, but as a percentage of the assets held in that fund, 60% of its net assets are embedded capital gains. Then, right after you buy the fund, it is forced to liquidate its entire position. Miraculously, the liquidation of the fund doesn’t depress your assets and you are made whole. You receive the entire $100,000 back and think you lost nothing.

But guess what? You owe the IRS money!

There wasn’t a felt capital by you at all. You invested $100,000 and received $100,000 in return for a real gain to you of $0.00. However, because of the magic of mutual funds, you actually have a capital gains distribution of $60,000 because of these embedded gains. You would be subject to a taxable capital gain of $60,000 when you personally felt no gain!

This is an extreme example and isn’t very likely to happen. But a portion of that does happen, and it most often occurs in exactly the years in which the market has fallen.

It is a double whammy! The market sells off and you are hit with a capital gains distribution.

Invest With Dupree Financial Group

Is there a better way to diversify your holdings and avoid a capital gains distribution?

Most definitely!

You are purchasing open-end mutual funds and receiving capital gains distributions in which you don’t control at all. Instead, you could purchase individual stocks that meet your long-term needs.

Only then will you know what your exact cost basis is for your equity holdings.

And this is exactly what you get from us at Dupree Financial Group, LLC.

Using our services, you can own individual equities. And when you purchase individual companies, you don’t inherit embedded gains like you do with a mutual fund. With our firm, you also get the benefit of a relationship with a trusted financial advisor. We have over 40 years of experience building wealth for our clients. And our value-oriented approach to investing can help you build your portfolio in any investment climate.

The down market that we have been going through this year actually has us excited for the future. It is this exact climate that real wealth can be created. Opportunities abound in this climate and could set the stage for tremendous returns.

The investment software that we utilize also sets us apart from our peers. It keeps you, the investor, constantly informed on your positions. With us, you will never be left in the dark about the cost basis of any of your investments: no surprises at tax time.

If you have your money sitting in mutual funds of any type, this might be the perfect time for you to get a no-obligation second set of eyes on your portfolio.

We don’t know about you, but we detest tax bills, especially when they are a surprise!

Contact us today.