Recency bias makes investment shoppers miss out on some tremendous bargains.

Imagine the following scenario.

You are shopping at a fashion boutique and that cute sweater catches your eye.

It is that same sweater that you saw last time for $150.00, but now it is on clearance.

The price has come down 80%. It is now only $30.00… Wow!

You inspect it; it isn’t damaged.

You still like it; so, you try it on.

It fits perfectly, and it feels amazing against your skin.

You already have the perfect shoes to go with it, and it goes well with about everything you own.

But you put it back on the rack and walk out without purchasing that perfect sweater that is selling for pennies on the dollar.

Why would you do that?

Since it is on sale, nobody else wants it anymore! It is perfect for you, and you loved it when it was $120 more expensive. But now that it is 80% off, you look at it like it is a rag. It’s a discarded garment that is so out of favor it will never provide you the value that you need in a piece of fabric.

Then, let’s say you go back to that same store the next weekend. The sweater you loved is still there but now it is no longer on sale and the price is back to $150.

So, what do you do?

You buy it immediately because you just know that if you don’t buy it right now you might have to pay more somewhere else. It has gone back up in price, and you fear that you are going to miss out.

Does this make sense?

Very few, if any, of us shop for our outfits this way. However, this is exactly how the herd of investors purchase their equity investments. It is a mindset that says, “Hey that stock is going up, so it will just keep going up forever”. Or, more recently, “that stock is down 80% so it not any good”.

It doesn’t matter how well the stock fits your portfolio, or how good it feels against your skin. The only thing that matters is that nobody loves it right now. So, you will wait for it to go back up before you buy it.

That in a nutshell is how recency bias works, and it might be killing your investment wardrobe.

This article will take a look at some evidence that shows that not only is this a real phenomenon, but how much it really costs the average investor.

Recency Bias Scares Investors into Selling Low

If you are like many investors, you don’t look at your investment performance on a daily basis.

But once a month, you get a statement in the mail from your brokerage account and your 401k.

This month, you open your statement, and you get a shock. You can’t believe how much money you have lost.

After you pick your jaw back up from the floor, you want to act. And like countless others, you feel the urge to sell your equity investments. At least if it is sitting there in cash, you won’t lose any more money, other than to inflation.

Even though we like bear markets because we find opportunities in them, we understand this gut-wrenching feeling. It is painful to open up your statements and see that your asset values have fallen, sometimes precipitously.

And after a couple consecutive statements that show a continued fall in value, you might start to think it will just go down forever. You finally sell everything, so you don’t have to see those statements continuing to fall. Whew, you think, what a relief to not have that pain anymore.

Don’t Sell Good Companies Just Because They are Cheap

This form of recency bias scares investors into selling good companies at what might turn out to be the absolute worst time to sell, and it happens time and time again.

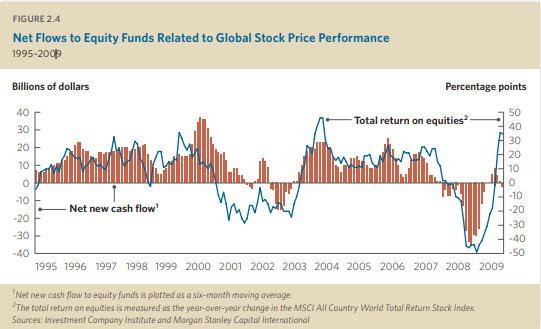

Take a look at the outflows from equity funds during down markets.

Just before the end of the financial crisis in 2008-2009, net flows into equity funds were hitting negative $200 Billion. Just when the market was bottoming, many investors threw in the towel. They were sick of getting sticker shock every month and ran for the exit.

There were certainly reasons to be scared at that time. However, quality companies with pricing power endured. Just like that sweater that felt great on your skin, they were on clearance and very few investors wanted any part in owning them.

Recency Bias Causes Investors to Buy High

The opposite thing happens in the midst of a bull market.

Instead of getting your statement and feeling pain you are overjoyed that the companies that you have in your 401k have gone up in value. Or you are hearing from the news that the market is going up, up, and away.

You fear you are missing out and want to ride the wave of investor enthusiasm to the stratosphere, and you want to jump in with both guns blazing.

The market is going to just keep going up, and you fear that you are missing out. You might not have had much interest a year ago when the market seemed like it was just going to keep falling like a rock, but now…

Things are different!

Now that equity prices are trending higher, you want to get back into the market.

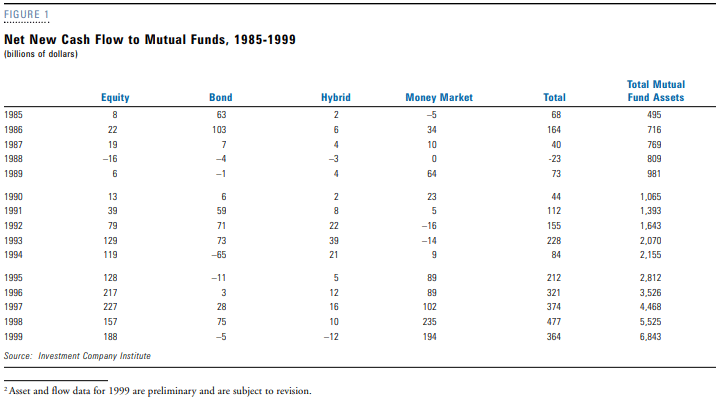

This recency bias can be seen with respect to inflows into mutual funds during bull markets.

In 1999, net new cash flows to equity funds were +$188 billion. This was just as the market was peaking during a long-term bull market. From 1987 to 1999, mutual fund assets had grown from $769 billion to nearly $6.9 trillion. The recency bias of a seemingly permanent bull market had made investors complacent, and they just wanted in no matter what the price.

Most of us experience FOMO (fear of missing out) from time to time. When the stock market is in the middle of an upswing, you are driven to make that easy money.

And it is always a good time to own a quality company that has pricing power. But wouldn’t it be more rational that people would want them when they are on sale.

It might make more sense, but few investors do this!

Net Impact of Emotional Investing

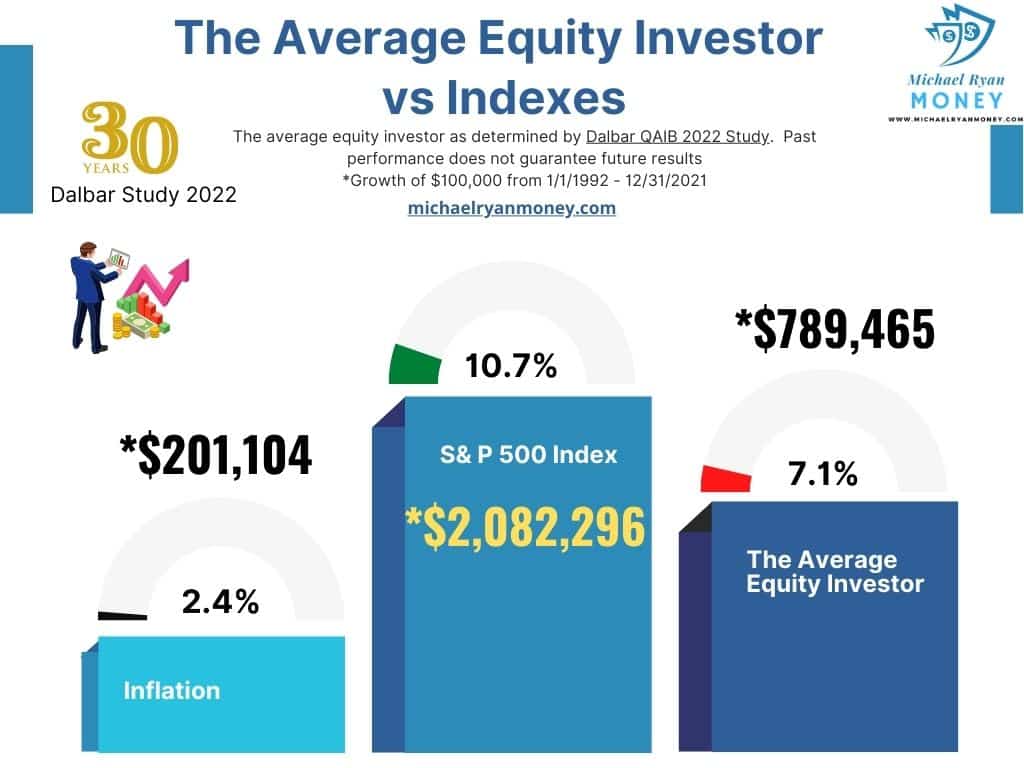

Reacting to recent events costs investors dearly. Selling low and buying high because of what happened yesterday causes long term underperformance.

In fact, had you invested $100,000 and achieved average returns since the start of 1992 your investment would have been worth over $2,000,000 at the end of 2021. The average investor, however, would have only seen that value grow to $789,465. The main reason for that underperformance is neither trading fees, nor asset management fees. Rather, as the Dalbar QAIB 2022 study shows, it is that the average equity investor does a bad job of market timing. They buy high and sell low time and time again due to recency bias.

Investors that have been able to overcome their own urge to sell in a panic and overreact to raging bull markets have done much better than their peers. By staying in the market, no matter what the recent news has been, investors historically would have had much more money over the long run.

How To Overcome Recency Bias

Research and knowledge breeds confidence!

Clearly, staying in the market ,historically, is the way to go. But you need a guide.

Without a trusted financial advisor, you may well fall into this recency bias trap just like millions of your peers.

With a cumulative 90 plus years of investment experience in our firm, the only way to stay calm in a sea of volatility is from performing due diligence.

Research, research, research…

Research is at the heart of everything we do as investment professionals at Dupree Financial Group, LLC. We have intimate knowledge about the companies in which we invest. We understand how these companies add value for their customers. And only through understanding their business model, and their long-term value, can we effectively help you overcome recency bias.

This hard, disciplined work gives us the confidence to stay invested for the long term no matter what the current investment climate.

The stock market goes up and down… good companies endure.

Just like that sweater that feels so good against the skin and goes well with your wardrobe, when we find a company that is on sale and fits so well with our clients’ investment portfolios, we want to buy it when it is on sale.

Contact us today to get a no-obligation look at your investment portfolio. It is always a good time to get sage advice from an experienced investment professional.