Active management is better than investing in passive index funds. This is especially true in a down market.

Consider this scenario: A scenario that is playing itself right before your very eyes.

The market is down, and so are your investments…

Why? What are you doing wrong?

Is it because you chose bad investments?

Or is it because all of your babies are getting thrown out with the bathwater?

The bigger question is this…

Do you even know what you own?

If you remain invested in index funds, you likely have very little idea (other than to just be invested ‘in the market’ whatever that means).

It has been largely viewed as ‘sage’ advice to just go out and buy the broader index as a whole.

And we understand the allure.

The fees might be lower.

You feel like you are immediately diversified.

However, there are several problems with index funds.

And these problems seem to scream at investors every time there is a market selloff.

When the market is going up, everyone is happy, and they feel smart. They made money in their index funds, because the market went up. But when the market takes a dip, they become fearful, and lost. They make rash decisions that curtail their long-term success, and most of this happens because they do not have a trusted advisor to give them the confidence to stay in the game. This article will highlight 4 of the major reasons why we prefer active management to passive index fund investments.

You Should Choose Active Management Because Index Fund Returns Are Not Great!

The advertised promise of Index Funds is that you will achieve a greater return over the long term with an extremely low-cost index fund because management fees will pick away at your investment earnings over time.

In fact, Warren Buffett made a bet of $1 million dollars to ‘prove’ that index funds would perform better than any selected basket of 5 hedge funds over the course of 10 years. And in 2008, Protege Partners LLC took the bet. In the first 4 years, it looked as if Protege Partners were going to win. However, by the end of the 10 years the index funds won. So, index funds must be the way to go.

Not so fast…

Although this bet worked out in Buffett’s favor, it ignores a very important factor.

An often-overlooked fact is that investors in index funds, as a whole, do not actually earn anywhere near the cumulative return the index boasts over the long term.

“Why not?”, you might ask.

The reason is that they, the investors, are human. And humans are irrational and emotional creatures.

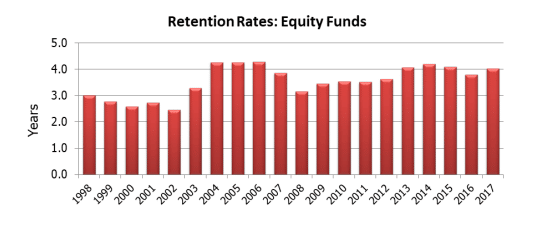

The ten-year holding period that was accepted in the challenge does not reflect the actual average holding period of the average equity fund investor whether it is index funds, hedge funds, or active managed funds of any sort. In fact, the average actual holding period for the average equity fund investor was actually 3.55 years for the 20-year period from 1998 – 2017. This period encompasses the holding period in the Buffett bet. And take a look at the actual holding/retention periods during those 20 years:

Investors Sold During the Panic

Look at what happened during the market meltdown in 2008 and 2009! The retention rate fell dramatically just as the market collapsed. Investors panicked and sold as the market was collapsing. As quality companies became cheaper to purchase, very few investors wanted them. This happens time and time again. As a result, the average investor in index funds actually achieves a much lower return than what is advertised in the index.

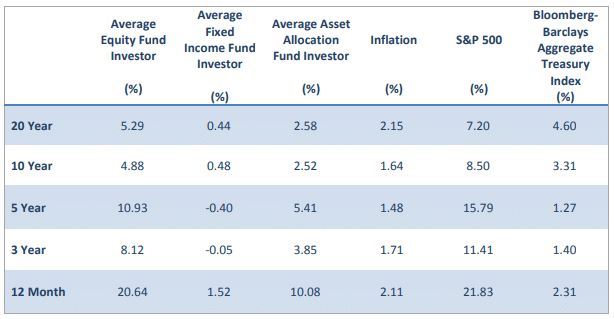

During this same 20-year investment timeframe, the average investor achieved an average return that was about 3 percent below the S&P 500 per year. Is this because they invested heavily in extremely high cost actively managed hedge funds?

Nope!

Index fund investors cannot beat the index! Even If they stay invested continuously, they will underperform the index by at least a small margin. But they actually do much, much worse than that. This happens because the average investor is terrible at timing the market.

They hurt themselves so much, in fact, that during the 10-year period ending 2017 the average actual return that equity fund investors actually realized was 4.88% annually. This was much worse than the S&P 500 index average which boasted an 8.5% average annual return. That is a whopping 3.62% annually for 10 years.

What?! How did this happen?

Was it because active managers charge around 1% to manage their funds?

No, the largest reason for this underperformance is because retail investors sell into the panic and buy when a bull market is in full force. Investors, as a whole, are very poor at knowing when to sell and even worse at knowing when to buy.

Had an actual investor invested $100,000 with an active portfolio manager that achieved average results and charged 1% to manage the assets, they would have been left with $211,700. If they did it themselves and behaved as the average investor, that $100,000 would have been worth $143,620. That is still a good result compared to inflation, but as the famous active portfolio manager Peter Lynch said, “good is the enemy of great!”

I think it is also worth noting that the investor that issued the challenge, Warren Buffett, is himself possibly the most famous active investor of all time. He didn’t make his fortune by purchasing an index fund.

That is one reason the average investor needs an experienced active research analyst working for them full time. That is exactly what you get with the right registered investment advisor.

Even Without Active Management, You Still Have a World from Which to Choose

Another thing that seems to be appealing, at least in concept, to the passive investment crowd is the thought that you just buy the index and set it and forget it (which few investors actually do in practice).

But… What index?

There are about 5000 different indexes to choose from and over 27000 different index funds. There are more funds than actual equities listed on the NYSE and NASDAQ combined. Both foreign and domestic listings on the NYSE total just 2584 at this time, and the NASDAQ lists 3790.

What is the right one to choose, and why is it ‘right’?

This is the ultimate question. With all of the choices available in index funds, how do you know you are making the right choice? Well, it depends…

The biggest factors are your personal level of risk tolerance and your personal goals. As already stated, personal investment behavior proves to be a huge drag on long term investment returns. With a well thought out strategy backed up by research and understanding, you can overcome your own fear-based behavior. Without that, you will most be faced with the same fate of the other woeful underperformers.

With so many choices, investors can get confused.

This is another reason you need the help and counsel of an active manager. You don’t have time to research thousands of funds to help you achieve your ultimate goal.

It is Challenging to Understand the Investments Held in Your Index Fund Without Active Management

Even if you put in the research and think you are making the ‘right choice’ in an index fund, it is challenging to understand what you have purchased. You will just know you are ‘in the market’, whatever that means. Whether you are investing on your own or having a professional manager help you achieve your goals, you should always invest in what you know.

“Invest in what you know” – Peter Lynch

One commonly held index is the S&P 500 index. This index just simply invests in the 500 largest companies by market capitalization. For one individual investor it is nearly impossible to be up to date on all of the inner workings of these 500 companies. And even if you could, they change all the time. On average, 20-25 companies are removed from the index to make room for new entrants.

And is every member of this index ‘right’ for an investor?

Are you interested in yield?

Right now, the highest yielding member of the S&P 500 is Lumen Technologies and currently yields 14.99%. Conversely, there are currently about 80 members that make up this index that pay no yield at all. Why would it make sense for an income seeking investor to invest in all 500 of these companies?

How about value?

One popular and simple metric used as a starting point to look at value is price to book value. The companies comprising this index have a wide range in this ratio. These companies have as low as a .4633 price to book ratio and as high as 3,585 times book! Does it really make sense for the same investor to own both of those companies? Maybe, maybe not.

By purchasing the index, you have no idea what you actually own. By merely owning the index, you own a small piece of everything and as we all learned from Different Strokes, “what might be right for you may not be right for some”.

Index Funds are Forced to Buy High and Sell Low

Another often overlooked problem with index funds is that they force investors to buy high and sell low.

Hang on a second… isn’t that the exact opposite of what we should be doing?

Let me explain…

The Standard & Poor’s 500 Index simply tracks the performance of the 500 largest companies (by market capitalization) listed on exchanges in the United States. When a company falls in market value, it is replaced by another equity in the index. Therefore, and for this reason alone, the index fund is forced to liquidate its position in that equity and replace it with the new entrant. So, in essence, the cheaper company is sold and the more expensive is purchased. If the company recovers and regains its membership in the S&P 500 the process happens in reverse. The index fund would be required to buy the company back again in favor of another company dropping from the index.

Does this process of investing make any sense?

Not to us it doesn’t. We don’t want to sell a company that we love because it fell in market capitalization ranking from the 500th to 506th. In fact, we might even want more of it.

Has this negatively impacted performance?

The answer to this question is a most resounding yes! This irrational investment behavior has most definitely had a negative impact on the investment returns of S&P 500 index investors.

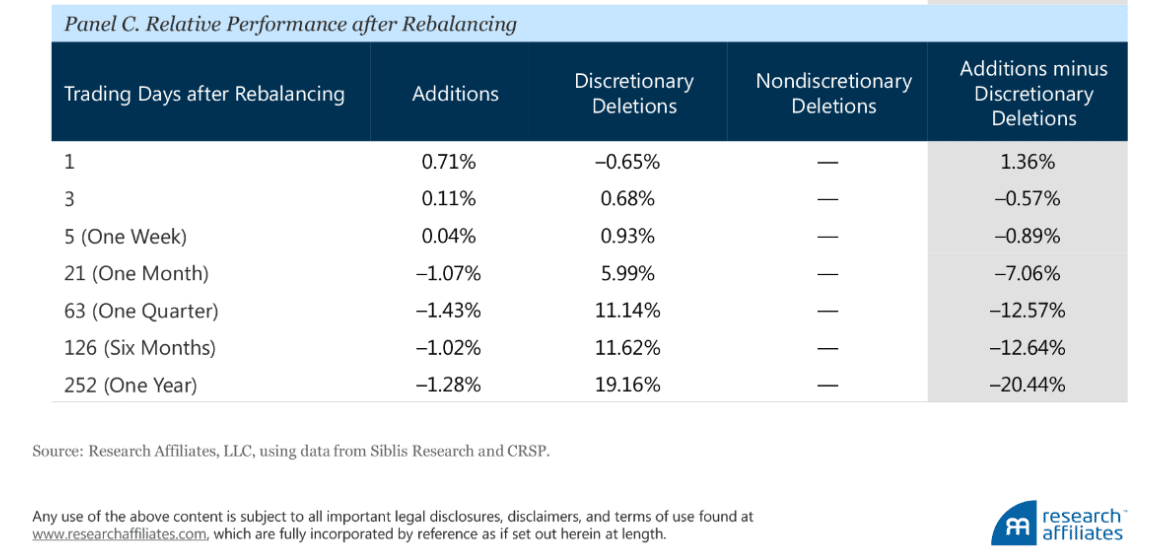

From 1989-2017, the highfliers that were added to the index tended to be priced at valuation multiples that averaged over three times as expensive as the companies that leave the index. And without active management you are forced to buy these companies.

During this 28-year timeframe, these added companies underperformed the companies removed from the index by an average of 2,200 basis points in the 12 months following the addition/deletion. Look at the chart below:

It happens over and over again. On average, during the 28 years ending December 2017 companies that were removed from the S&P 500 index for no other reason than having been passed in market capitalization were up 19.16% one year later. How did the added companies perform? Not surprisingly, they were actually down 1.28%! Without active management, you will have no chance to participate in this continued reality. You will constantly be selling valuable companies that are trading at a discount just to buy highfliers that could likely underperform as they have in the past.

Get a trusted investment advisor so you don’t have to possibly miss out on this 20% spread in the future.

You Need Dupree Financial Group, LLC

You need active management to tailor your portfolio to best suit your needs, not just an index of problems. Now is the right time to stay invested. And with the help of an active portfolio manager that has the experience to weather any market condition you will be able to stay committed to your personal strategy. You will gain investment confidence by knowing that your registered investment advisor has done the research to know exactly where your money is invested and why, so you won’t miss out on the next great bull market. Contact us today!