When is the right time to sell a stock for a profit?

All your hard work is paying off.

You have done your research and you made a wise investment.

Your stock is up, and you are sitting on a tidy profit.

But what should you do now?

Should you continue to hold this stock?

Or…

Should you sell it and take some profit off the table?

If you are still reading this… Congratulations!

Overall, it has been a tough year to find much to cheer about in the stock market, but you have struck gold.

Or more likely… struck oil!

If you happened to buy a company that we own, EOG Resources, INC (EOG), you could be sitting on a tidy profit. On the first trading day of 2021 the company was trading for $50.93 per share. The equity has recently traded for over $125 per share providing you a paper gain in excess of 145% in a relatively short timeframe.

That is an impressive gain, but should you let it ride?

The answer is more complicated that you might think.

There is a science to knowing when to sell your stock for a profit. This article will highlight a few reasons why this might be a good time to think about reducing your position in your winners.

If the Fundamentals Have Changed You Might Want to Sell

To win long term with your investments, it is imperative to continuously stay up to date on the companies that you own. The business landscape is constantly changing. And as they change, so might the long-term growth prospects of your holdings.

No matter how big or small, if the company doesn’t change with the times its prospects can worsen. And it just might be time to sell.

History has shown that management can, due to its own hubris, ignore huge trends that will make a lasting impact on its own operations. And, thanks to one former highflier, we even have a word for something that was once popular but is now irrelevant.

That is so Kodak!

Kodak was once a darling member of the nifty fifty. The company started manufacturing cameras in 1888 and implemented a razor model. They sold their first cameras for $25.00 which came preloaded with a roll of film. The company made the dream of photography available for the common man. They made the slogan, “you press the button, we do the rest”, a reality for Americans. For the low cost of $10.00 you could mail your camera to the company. They would then process the photos and send your camera back to you fully loaded.

It was a game changer. They were a technological marvel of the day!

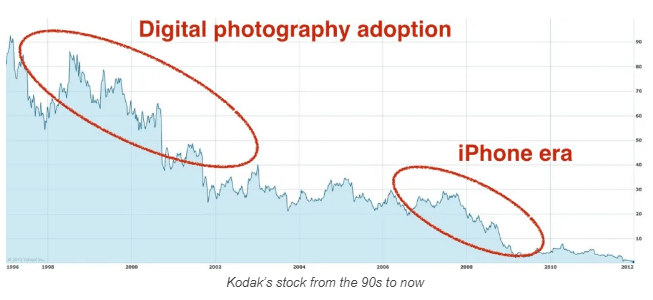

But the technology changed, and the company’s inability to quickly adapt to new technology made them… well… kodak.

You could see it happening right before your eyes.

In the 1990s, the digital camera revolutionized the way people stored, printed, and shared images. This eventually destroyed the business model that Kodak employed. The new paradigm was more efficient, and consumers slowly changed.

Interestingly, it was actually an engineer at Kodak that invented the first digital camera back in 1975. His name is Steven Sasson, and he still works for the Eastman Kodak Company in an intellectual property role.

Kodak Shelved the Digital Camera

Upon showing management the new digital camera, management shelved the project. And, according to Sasson, was told that his invention was cute but to not tell anyone about it.

Instead of fighting for control of this new technology, the company shelved it and tried to keep it under wraps to protect its lucrative printing business. This strategy ultimately failed as Sony came out with its own digital camera six years later. It took a while, but ultimately the writing was on the wall.

The lessons of Kodak are illuminating. Staying intimately aware of your company’s fundamentals and competitive landscape can signal when it might be the right time to sell your stocks for a profit.

Dividend Cuts at Kodak

Publicly traded companies are typically very slow to cut dividends. Solid companies with tremendous growth prospects can slash its dividend for good reasons. But, any announcement of a reduction of its income payouts to shareholders should be closely examined.

Way back in 1988, Kodak paid 50 cents per quarter in dividends. By 1994, that had fallen by 20% and the company was paying only 40 cents per quarter. Even if you didn’t know that the company had shelved the digital camera, this should have been a trigger to at least reevaluate the long-term prospects of your investment.

And the same thing goes for companies today.

If the company you own just announced a 20% cut to its yield, it might make sense to seek a financial advisor. Get a second set of eyes on your position to see if it still meets your overall investment goals.

Earnings Announcements at Kodak

Way back in October of 1994, the company also announced a 31% decline in its net income when compared to the year ago period. And announced further cutbacks and a potential restructuring of the company.

Surprisingly, the stock actually closed up $.25 on the day.

And if you read into the earnings report another even more alarming trend could be noticed. The gross margin was decreasing. When gross margins are decreasing this can mean that the competitive landscape has changed for the services that the company offers. That was exactly the case with Kodak.

When your company is seeing decreasing margins, lower earnings, and cutting dividends it might be time to sell whether or not your investment is currently showing a profit. And it is definitely time to at least evaluate the company more closely.

The Winning Stock Has Become Extremely Overvalued

Value, value, value!

That is the heart of everything we do at Dupree Financial Group, LLC. We help our clients increase their wealth by investing in companies that are poised to deliver sustainable returns. And for these returns to be realizable, we must invest in companies that we find to be undervalued.

One terrific reason to sell a stock for a profit is because, even though the company might be great, the stock has gotten ahead of itself.

If the stock has risen so much that its price is no longer aligned with the expected cash flows the company might generate in the future, it could be time to alter your exposure.

You don’t have to look very far in the past to see this exact scenario at work.

The great pandemic caused a great shift in the way people worked. Remote workers grew by 33% in 2021 alone. And valuations in technology companies exploded, especially the so-called FAANG stocks.

A great company like Zoom Video Communications, Inc (ZM) burst onto the scene and saw tremendous growth. Remote workers flocked to its software to help stay connected to the office. And in 2020, the stock price reached the stratosphere trading for $559 per share on October 21st of that year.

The products the company creates are terrific. Zoom is being used everywhere and has been a tremendous help, especially to remote workers. But it was possible that the share price had gotten way ahead of itself.

What has happened since?

At the close on December 14, 2022, the equity closed for $73.22 per share. This is a nearly 87% reduction in the underlying stock price.

We think Benjamin Graham said it best, “In the short-term, stocks are a voting machine and in the long-term, stocks are a weighing machine.”

And one measure of that weight is the actual cash flows that the company will actually achieve in the future.

This should not be confused as a recommendation on any stock, it is just an example. When a company you own has become overvalued it might be time to reevaluate your position and sell it.

Your Profitable Stock Makes Up Too Much of Portfolio

You are riding a huge winner in your portfolio.

That is great news.

From time to time, though, this great news presents a great risk.

Your portfolio may become way too heavily concentrated on this one huge winning position.

As a result, your investment portfolio has a lack of diversification.

And diversification risk can cause big problems down the road.

You might have a big gainer that is still fairly valued or even undervalued. But if things turn sour for this company (and it might), a heavy concentration of exposure in this one company could decimate your returns quickly.

You can’t eliminate market risk by diversification, but you can certainly lessen the concerns of one single entity and that can be extremely important.

As the saying goes, “don’t have all your eggs in one basket!”

Get Advice from Dupree Financial Group, LLC

The main advice we are giving you about when to sell a stock for profit can be broken down into two main categories: value and portfolio management.

And that is exactly the advice you get when you have Dupree Financial Group, LLC. working for you.

We are a value-oriented investment firm. We perform the due diligence and the hard-hitting research that builds our clients’ wealth for the long-term.

Before you sell your stock for a profit, get a no-obligation second set of eyes on your portfolio.

It is always a good time to sit down with a trusted financial advisor and get a fresh perspective. Contact us today.