I heard you got a new job and are about to change careers at 40.

Congratulations!

My hat is off to you.

You have worked for this moment.

After countless networking events…

You’ve held several interviews (oftentimes with the interviewer being wet behind the ears)

And now finally, after what seems like an eternity, of searching and striving…

You are embarking on a new journey

A new career…

A new life…

Pat yourself on the back, you deserve it.

And now, the work begins.

I know this time can be hectic as you transition to your new role.

But, know this, you are not alone.

In fact, the average age of someone who changes careers in 2022 is 39 years of age.

I realize there are many things that you need to do as you transition to this new role. One very important thing that often gets lost in the shuffle is your retirement plan from your soon-to-be former employer. As of May 2021, it was estimated that approximately 24.3 million forgotten 401(k) plans were left with former employers and those assets equated to $1.35 trillion.

Wow!

This alarming trend persists in the United States, and the amount of assets that employees leave behind with their former employers continues to grow.

With all of the other things that you have going on right now, why should you not become just another statistic?

Why shouldn’t you leave your financial future in the hands of your past employer?

There are several reasons why you should talk to an investment advisor about your 401(k) and other retirement accounts as you embark on this new journey in your life.

Take control of your financial future.

You Might Forget You Have the Money When You Change Careers at 40

This might not seem possible right now. After all, you have been contributing to this plan for years. Over time, however, our minds move on to other things.

Out of sight, out of mind

Men and Women that change careers after 40 average 2.9 jobs for the rest of their working years. So, statistically speaking, this probably isn’t your last rodeo.

In 2018, Boston Research Technologies conducted a survey in which they interviewed 1000 inactive defined contribution plan participants. These inactive participants had left an employer and failed to rollover their retirement plans with a trusted advisor. Rather, they left the assets with their former employer. Fully one-third of those interviewed were unaware these funds existed.

And the forgetfulness grows over time. The longer it has been since you worked for this employer, the more likely you are to forget about these funds.

Don’t let your money get lost in the shuffle.

Your Risk Tolerance Changes When You Change Careers at 40

Another often overlooked, or never considered, reason to take your money with you when you change careers is that you are now less likely to want excessive risk in your investments. You likely made investment decisions when you first started with your soon-to-be ex-employer and have not made any updates throughout your tenure.

Don’t let yourself remain invested in an old plan when you have new needs.

An analysis of over 30 million active defined contribution plans in 2021 revealed that fewer than one in twenty participants made any changes to the allocation of their contributions. This fact is in stark contrast to the reality that a major life change occurs, on average, every 12-18 months. If you have been with your current employer for 10 years or longer you have likely had six or seven major life changes.

You May Become Overweight in Your Former Employer’s Stock When You Change Careers

In total, approximately 4.5% of all 401(k) assets are invested in the stock of the employer. But many 401(k) plans are very heavily concentrated in the equity of the company.

As recently as 2016, Sherwin-Williams employees had 62% of their retirement assets invested in company stock. The company may want to “Cover the Earth”, but they might also want to spread their employees’ assets around the Earth as well.

This company was not alone in this extremely high concentration of company stock in its employees’ retirement plans. And there is a legitimate reason for this phenomenon. Many retirement plans have a company match. Rather than use cash, employers can use their own stock to fund the match.

Back in 2016, Colgate Palmolive employees were 56% invested in company stock. And the list goes on:

- Exxon Mobil (54%)

- Lowe’s Home Improvement (50%)

- PACCAR (50%)

- Dillard’s Department Stores (48%)

- Chevron (44%)

- McDonalds (39%)

- Costco (38%)

Talk about risky!

This is way too high of a concentration in one stock, especially for a former employer.

Why would you want to continue to have a high concentration of your retirement savings invested in a former employer?

After all, they couldn’t manage to keep one of their most important assets… you!

You left them for a reason, why should you let them continue to control your financial future?

There is always a chance your old employer could go bankrupt.

I am not suggesting that any of the aforementioned companies are going to go bankrupt, but I this lack of diversification reminds me of the story of Roy Rinard.

Roy worked for Enron and, like many other employees of Enron at the time, was convinced to move 100% of his retirement assets into his company’s stock. I think we all know what happened with this once huge company. His retirement assets were nearly wiped out because he was extremely overweight in one company.

If you are 60% invested in one stock, it might be time to consult with an investment advisor.

Your 401(k) Plan Could Have Very High, Confusing Fees

Another reason to take control of your future and roll your former employer’s retirement plan to a trusted registered investment advisor is for fee transparency.

With a traditional 401(k) plan, there are a whopping four fee categories that impact the performance of your investments over your working life. There are investment fees, custodial fees, individual service and administrative fees. Heck there might even be fee fees.

There are so many confusing categories of fees that 73% of participants don’t have any idea what they are paying, and the other 27% can only guess. In fact, a recent survey by AARP showed that over 70% didn’t think they were paying any fees at all.

If you are one of the 70%, let me be the first to tell you… you are!

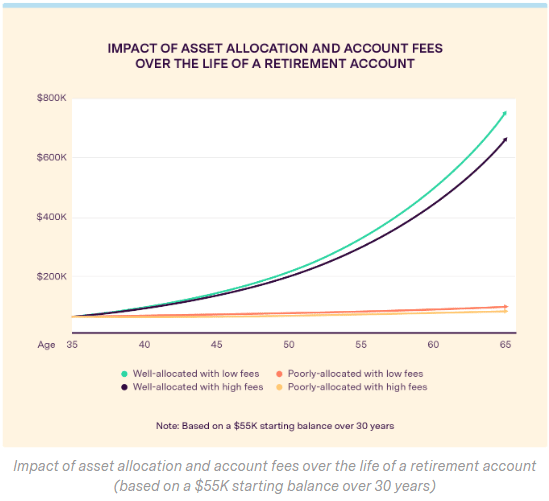

Although the fees are in your prospectus, you likely don’t know how much you are paying. It can be over 2% annually. By rolling your retirement plans over to Dupree Financial Group, you won’t ever be left in the dark about any fees associated with your investments.

Your Old 401(k) Could Have Very Poor Investment Allocations

Potentially, the biggest risk of leaving your retirement plan behind when you change careers at 40 is underperformance due to poor fund allocation. Nearly 14% of all plan assets held in orphan 401(k)s are invested in money market funds and “stable value” funds. For very short-term needs money markets are fine. If you need access to an emergency fund, holding assets in money markets is a wise decision. These funds pay some interest and have little, if any, risk. However, over the long run it is not advisable to have your retirement assets earning the paltry returns that these funds generate. This is especially true in an era of high inflation, and continuous increases in the fed funds rate.

It is estimated that the average investor could miss out on nearly $700,000 in retirement savings due to this poor allocation of investable assets.

In total, it is estimated that underperformance due to improper asset allocation will cost future retirees about $116 billion in retirement savings from these orphaned accounts alone.

Don’t become a statistic.

Make sure the assets that you hold in your retirement accounts are appropriate to help you achieve your long-term goals.

Rather Than a Hodgepodge of Investments, You Need a Personalized Plan Tailored to Your New Career

I think the largest issue with leaving your investment assets with your former employer is long term confusion. Over the course of the average person’s work life, he or she will have over 12 jobs. Nearly a third of employees have at least three retirement accounts, and nearly 30% leave their 401(k) plans with a previous employer.

This sounds like a confusing life to me.

The overriding issue though isn’t just simplicity, it is the absence of a plan that concerns me. There needs to be an overriding goal. And this goal can change over time.

Having several different plans spread out throughout different coordinators and advisors creates a potentially major problem. There is little, if any, communication between the plans. As a result, you will likely be unable to develop a cohesive plan to accomplish your long-term goals.

This means you, as the investor, will need to have regular meetings with 3, 4, or more investment professionals managing each account (which you likely won’t do). Or you can consolidate your investments as you continue to chart your career path.

Ahh… the simple life!

By consolidating your accounts over time with one registered investment advisor, you will be able to meet with one company that knows you and your goals. They can help you stay on course with your goals because they know your big picture and help you continue to design your future.

Don’t miss your big picture!

You Need Help from Dupree Financial Group

Don’t stay in the dark any longer.

You need to rollover your retirement plan from your former employer. There is a great chance that you are heavily concentrated in their stock, or otherwise have a poor allocation of your investable assets. Also, you are likely being charged fees that you know very little about.

Your needs have changed over time, and you likely haven’t addressed those changes with respect to your retirement assets. This is especially true now as you change careers at 40.

You owe it to yourself and your money to begin a discussion with a trusted financial advisor that has been building wealth for our clients for over 40 years.

Contact us today to get a no-obligation big picture look at your financial future. You will be glad you did.